Completed capacity in the first half of the year improved on 2018 by 53 percent.

The U.S. wind industry reached a new high water mark of development in the second quarter, new information shows.

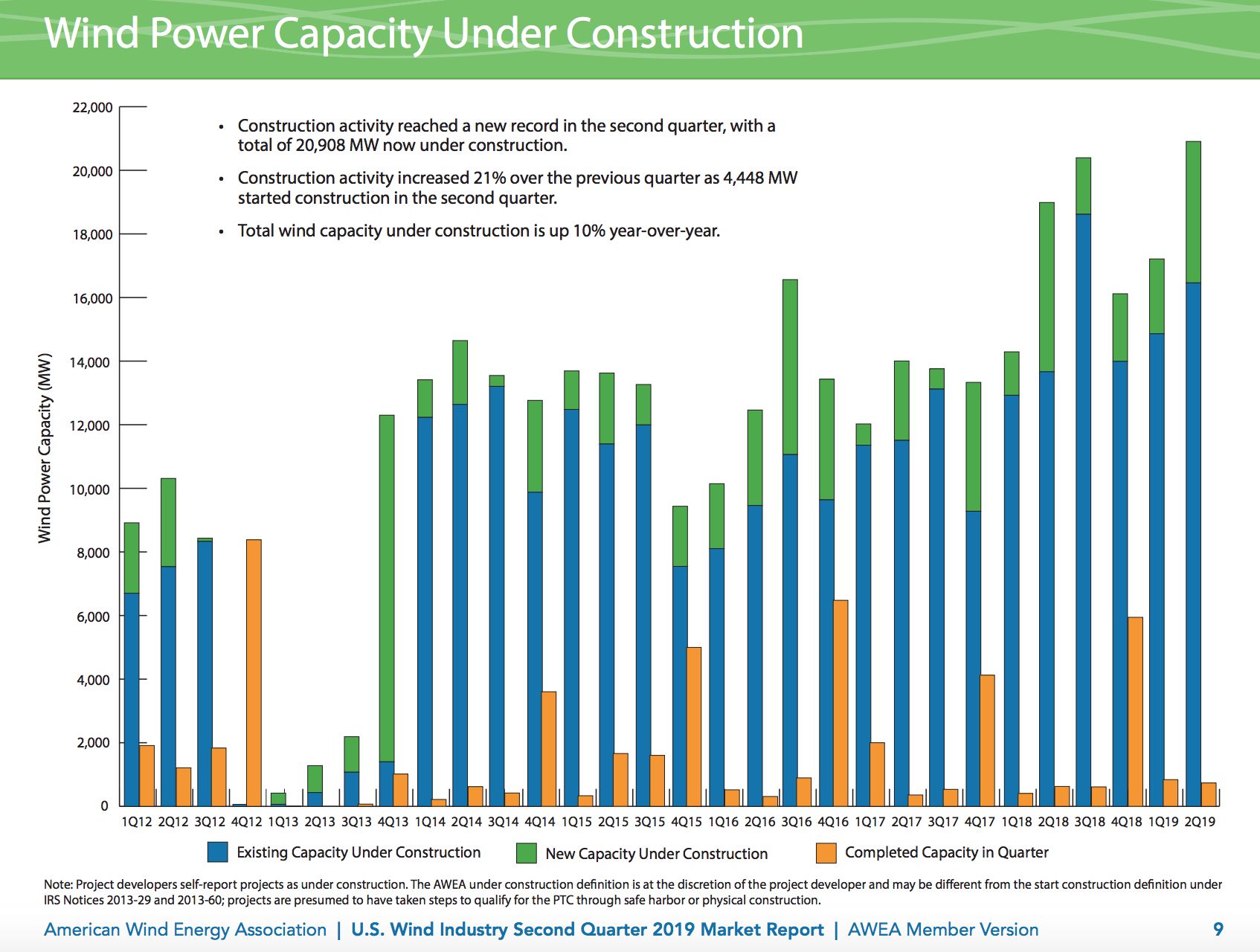

More than 200 projects are undergoing construction or late-stage development in 33 states, according to a new report from the American Wind Energy Association (AWEA). Those projects add up to 41,801 megawatts of new capacity, up 10 percent year-over-year.

The activity has diversified geographically in recent years. Nineteen states have surpassed one gigawatt installed, and 15 states currently are constructing or finishing up development of more than one gigawatt. Texas leads with 22 percent of the pipeline, followed by Wyoming, New Mexico, Iowa and South Dakota.

As for hard capacity additions, four new facilities came online in Q2 with a total of 736 megawatts. All but 2 megawatts of that capacity was located in Texas. That brings total U.S. wind capacity to 97,960 megawatts, according to AWEA.

Second quarter installations declined slightly from the 841 megawatts installed in Q1, but combined first half deployments increased 53 percent year-over-year. That said, the fourth quarter historically blows away all others by a margin of several gigawatts, so the end of the year will say a lot more about what kind of a year 2019 turns out to be for the industry.

The solar industry has done a similarly brisk business this year. It set a record for first quarter deployments with 2.7 gigawatts, according to the recent Solar Market Insight Report from Wood Mackenzie and the Solar Energy Industries Association.

This year will still fall short of the 2016 peak in solar installations, but should take second place with 13 gigawatts, up 25 percent from last year.

Corporate procurement drove 52 percent of the wind capacity contracted in Q2, followed by utility contracts with the remaining 48 percent, AWEA said.

The other market driver that picked up the pace in Q2 was offshore wind, which accounts for just five turbines of installed capacity in the U.S. presently, but promises gigawatts of new business in the coming years.

Mid-Atlantic states upped their offshore aspiration with new legislative targets: 1,200 megawatts in Maryland, 2,000 megawatts in Connecticut and 9,000 megawatts in New York.

Danish developer Ørsted won a 1,100 megawatt bid in New Jersey, and recently secured the 880-megawatt Sunrise Wind project in New York. The Empire State also chose Equinor’s 816-megawatt Empire Wind project; the two deals collectively add up to what state officials call the largest renewable procurement in the nation’s history.