Only 10-15 per cent penetration of electric cars is expected by 2030 in India: Report

This development is similar to that in China, where electric bikes and scooters laid the foundation for growth. Intra-city transport buses are also ripe for EV adoption. These segments are likely to be followed by fleet cabs, and then others

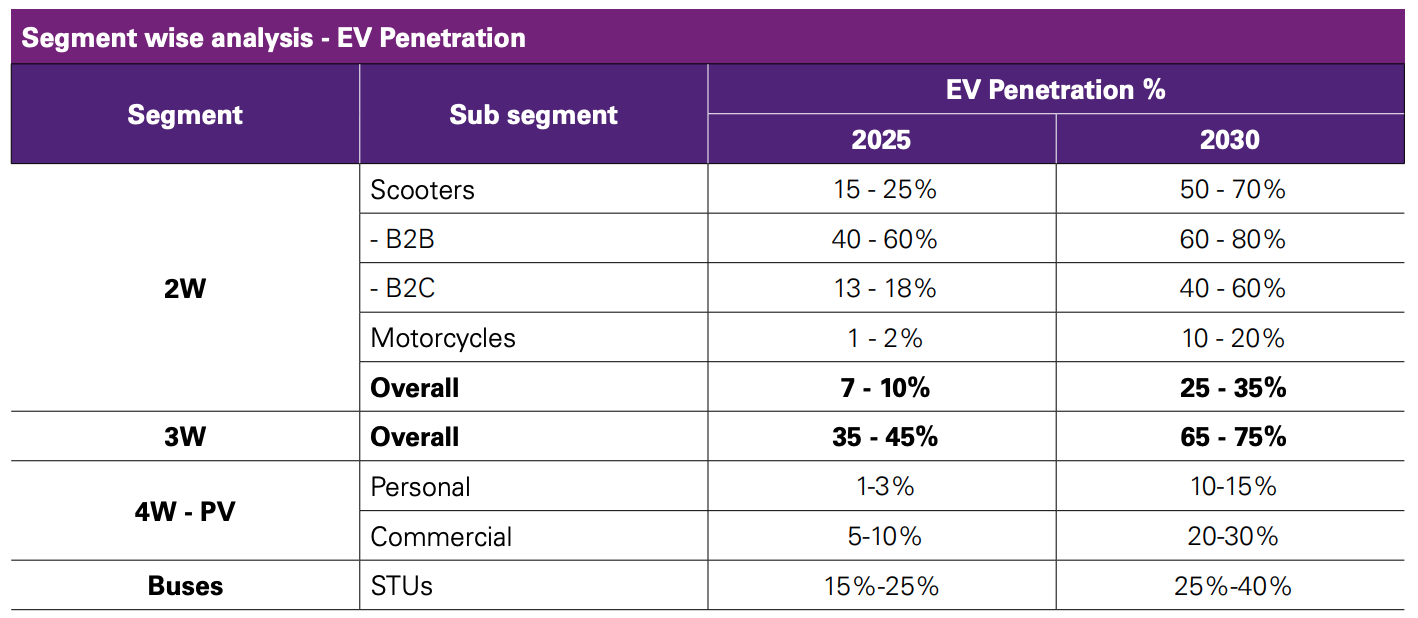

NEW DELHI : The light mobility segments of 2/3-wheelers and commercial cars will be leading electric vehicle penetration in India by 2030. The reach of electric cars in the personal mobility segment will be only 10 per cent-15 per cent. However, electric cars for ride-sharing and taxis may see traction of 20 per cent-30 per cent, according to a KPMG and CII report titled ‘Shifting gears.’

By the end of this decade, the three-wheeler adoption is expected to be around 65 per cent-70 per cent. Electric two-wheelers, with a plethora of startups offering different ranges of products at an attractive price and ownership models, are expected to have only 25 per cent-35 per cent penetration. Their price and fuel economy make them commercially more viable.

This development is similar to that in China, where electric bikes and scooters laid the foundation for growth. Intra-city transport buses are also ripe for EV adoption. These segments are likely to be followed by fleet cabs, and then others.

India is the largest two-wheeler market, with more than 80 per cent of ICE sales coming from the segment. The penetration of EVs in the four-wheelers segment has remained extremely low at ~0.1 per cent.

Several gaps in the four-wheeler EV market such as a limited number of products, high prices, insufficient battery promise, low performance and an underdeveloped charging ecosystem are yet to be filled. Given these impediments, the growth of EV four-wheelers is expected to lag behind other segments. Sales are expected to pick up once these gaps are plugged.

Rohan Rao, partner – industrials and automotive, KPMG in India, said, “Electric Vehicles (EVs) are on course to fulfil their promise as game-changers for the automobile industry. Two-wheeler (2W) and three-wheeler (3W) segments are likely to lead the adoption curve, followed by e-buses and passenger taxis. Directionally several factors, including the availability of charging infrastructure, robust financing ecosystem, reduced battery prices and increased customer awareness, are paving the way for a new era of EV adoption. The government is also pushing the EV policy to address some of the adoption barriers. EV is, thus, are emerging as a disruptive force, with several players experimenting with and discovering innovative business models and use cases. “

Challenges for local manufacturing

India’s phased manufacturing plans are likely to face challenges, according to the report, from the absence of adequate reserves of key raw materials like lithium and cobalt. India has to depend on other countries for its supply. The development of the battery industry, charging infrastructure and local supply chains are critical for EV adoption.

The Indian Space Research Organisation (ISRO) has transferred its in-house lithium-ion technology at a nominal fee of INR1 crore to 10 Indian industries for commercial production. This move is expected to lead to the establishment of lithium-ion cell production facilities for indigenous EVs.

Leading global players have shown interest in establishing cell or battery pack manufacturing facilities in India. The major Indian conglomerates also have outlined plans to set up such facilities.

Meanwhile, the government is assessing plans to incentivise domestic battery manufacturing. In January 2020, NITI Aayog sought cabinet approval for a proposal to provide subsidies to investors setting up giga-scale manufacturing units for lithium-ion batteries for EVs.

The government think-tank, in a recent proposal that is likely to be reviewed by the PM’s cabinet in the coming weeks, has recommended incentives of USD 4.6 billion by 2030 for companies manufacturing advanced batteries.

The proposal is to provide cash and infrastructure incentives of USD122 million in FY22, which may be ratcheted up annually.

India, with strong capabilities in certain EV components, other than batteries, can emerge as a hub for manufacturing and exports. These include wiring harnesses, permanent magnets, BLDC motors, AC induction motors, thermal and cooling management systems, electronics (other than semiconductors), plastics, etc. Auto component players in India are increasingly seeking to develop the requisite technological capabilities and capacities in these areas.

Public charging infrastructure

Across the world, electricity distribution companies and oil and gas players are developing solutions and entering into partnerships in the EV charging infrastructure space. While private chargers form a major share in the availability of charging infrastructure, public fast charging is also picking up.

In order to enable faster adoption of EVs, the government has issued guidelines and standards for public charging infrastructure wherein it has phased out plans for the roll-out of public charging infrastructure. Based on the proposals received, the union government has sanctioned 2,636 (public) charging stations in 62 cities across 24 states/UTs to be installed by 19 public entities.

Out of these, 1,633 are expected to be fast charging and 1,003 slow charging stations. With this, ~20,000 charging points are expected to be installed across selected cities.

Factors to fast-track electrification in India

Directionally several factors, including the availability of charging infrastructure, robust financing ecosystem, reduced battery prices and increased customer awareness, will pave the way for the new era of EV adoption.

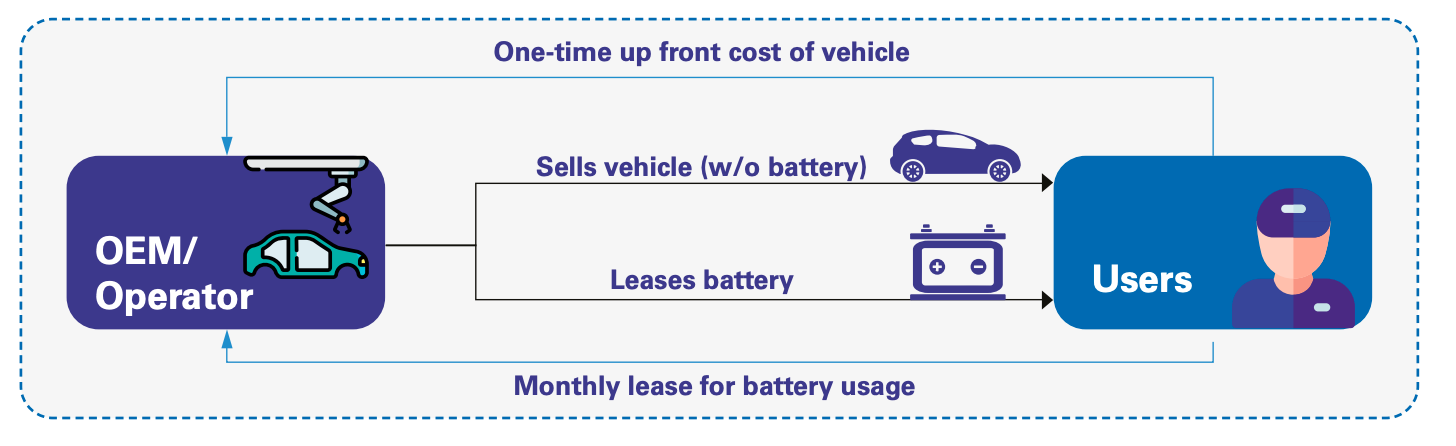

Innovative business models such as battery swapping have emerged to enable widespread EV adoption. The battery swapping model alleviates issues of long charging time, range anxiety, high upfront cost and battery reliability concerns for the EV owners. To make this model workable, the operator needs to ensure standardisation of batteries and operate in a closed-loop environment.

Recently, various tie-ups/partnerships have been entered between OEMs/Operators and leading oil marketing companies (OMCs) for battery swapping solutions like the one between Kinetic Green and BPCL.

To drive EV adoption, original equipment manufacturers (OEMs) and the central and state and governments need to work together for an integrated policy, creating a conducive ecosystem for India’s electric mobility vision.

A combination of enabling policy measures, infrastructure development, total cost of ownership (TCO) parity, and a market buzz-promise to fast-track the shift to electric, are needed for the dawn of a new era for the automotive industry. Only a few state EV policies provide guidelines and incentives on battery recycling. A coherent recycling policy is also the need of the hour.