Africa’s Wind Project Pipeline Grows to 18GW

There is growing momentum behind the development of long-term incentive mechanisms to support African wind markets.

The wind industry has been slow to take off in Africa. Developers commissioned projects in only four African markets in 2018. However, the policy inconsistency that has held the market back in previous years is beginning to change.

The continent’s wind project pipeline stands at 18 gigawatts as of Q1 2019, although the project realization rate in the region is still low due to a host of challenges faced by developers.

Cumulative wind power capacity in Africa stood at 5.5 gigawatts at the end of 2018. South Africa currently boasts the continent’s largest wind power market, with 2.1 gigawatts of operational capacity as of Q1 2019, according to new research.

The South African market is poised to grow, with the country’s government signing off on some long-pending power-purchase agreements in April 2018, which helped independent power producers (IPPs) to make their final investment decisions. In the longer term, South Africa’s integrated resource plan is expected to target more than 10 gigawatts of additional wind power capacity through 2030, while President Ramaphosa’s proposed reforms for the power sector will create a more favorable environment for renewable energy deployment.

Other project activity in 2018 included the 310-megawatt Lake Turkana project, the largest single installation on the African continent. It was connected to the grid in Kenya after a year-long grid construction delay.

Nareva Holding built the 205-megawatt Aftissat wind project in Morocco using SGRE turbines. Lastly, the New and Renewable Energy Authority of Egypt commissioned the final segment of its Gulf of El-Zayt extension, adding 120 megawatts of capacity in 2018.

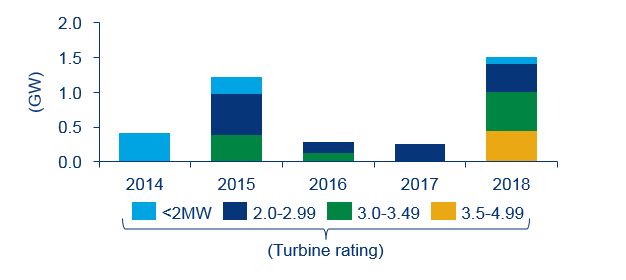

Turbine OEMs’ Firm Order Intake Trends in Africa

Source: Wood Mackenzie Power & Renewables

Industry watchers are now asking: What might help spur more wind development in Africa?

There is growing momentum behind the development of long-term incentive mechanisms to support African wind markets. Competitive procurement has proven to be the favored tool of policy support, with South Africa and Morocco introducing auction programs in 2011 and 2015, respectively.

Tunisia solicited bids from wind IPPs in 2017, while Kenya and Ethiopia are contemplating the launch of auctions for future installations. These developments mirror global trends where competitive procurement regimes have resulted in lower electricity prices in many countries.

It’s worth noting that this approach may have less success in emerging markets (markets that are expected to grow by less than 800 megawatts of capacity through 2028), as auction volumes may not be sufficient to draw the attention of global wind industry leaders.

As governments take measures to address market constraints, the African wind market is expected to recover and grow exponentially between 2019 and 2021. The expected growth is underpinned by a five-fold increase year-on-year in turbine order intake in 2018 and 6.5 gigawatts of wind capacity in advanced stages of development.

There are a few clear ways that these countries can consolidate their success going forward. Morocco would do well to introduce new rounds of auctions no later than early 2020s. The Egyptian government should implement a more rigorous policy framework for the long-term development of its wind power market.

As more African governments introduce long-term plans to support wind power and heed investors’ concerns, private-sector confidence in emerging markets will continue growing. These changes will enable the region’s maturing project pipeline to drive growth into the 2020s.

In one example of how this has played out recently, independent power producers in Tunisia were lukewarm to proposals due to concerns regarding the power-purchase agreement’s terms, which were considered unbankable by financiers and developers. The government addressed these concerns by revising the contentious terms. On the back of making these amendments, the government received substantial interest for the 620 megawatts of capacity it will award before 2020.

Similar favorable developments in countries including Ethiopia, Tunisia, Kenya, Algeria and Ghana offer a combined 6.2 gigawatts of wind market opportunity for developers and OEMs through 2028.