AGL says batteries starting to compete with gas generators for peaking services

Plunging costs and improved performance could see big batteries start to compete with gas plants to provide peaking services, and its an opportunity at least one of Australia’s largest energy companies is looking to seize, as the end of coal looms.

AGL Energy’s newly appointed chief operating officer, Markus Brokhof told RenewEconomy in an interview that there is a clear business case for big batteries, and added that they were starting to compete with gas peakers on commercial terms to firm up supplies of wind and solar.

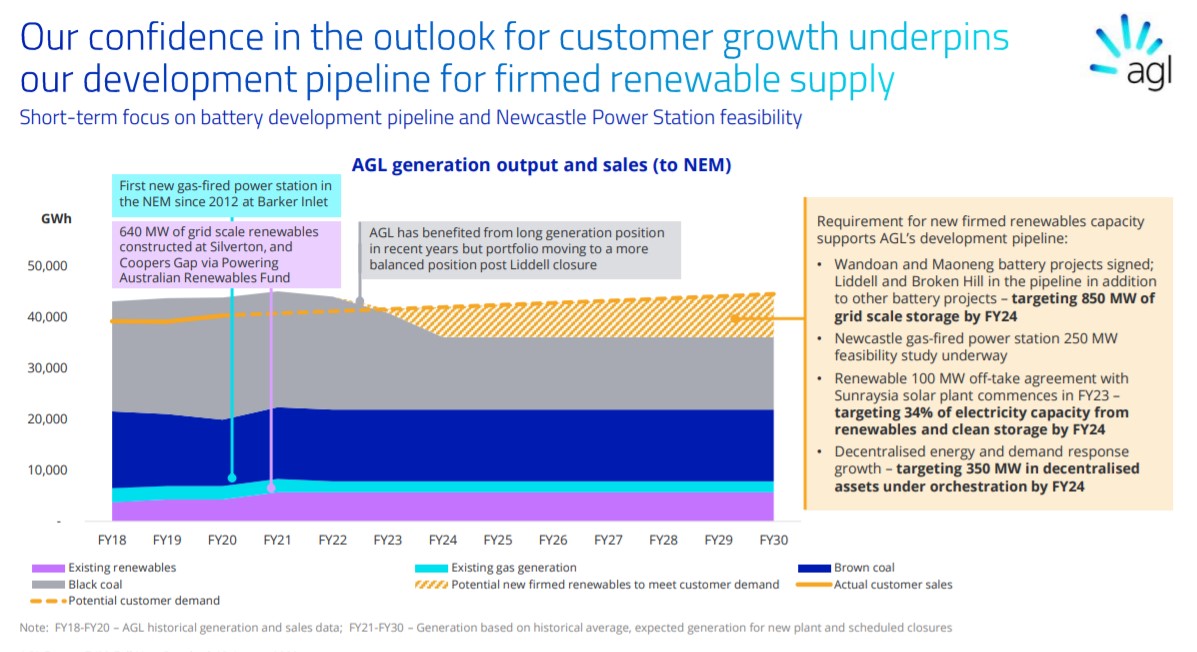

Last week, AGL revealed plans for a significant increase in its portfolio of large scale battery systems and will target up to 850MW of new big battery projects by 2024, and a further 350MW of distributed resources. The company sees a growing opportunity in the market for peaking, or firming, infrastructure as the market share of wind and solar grow.

The first of these newly disclosed battery investments is set to be located at the site of the Liddell power station, with up to 500MW in the one location. It will begin with a 150MW initial stage, followed by a similarly sized system, between 100MW and 150MW at the Torrens Island power station site in South Australia.

A third battery system is also being considered for a site in Victoria. A precise location has not yet been announced, but co-location at the Loy Yang A power station would be a possibility.

The decision to co-locate batteries at existing operations – where infrastructure was already in place – was a ‘time to market’ question, according to Brokhof, who said that the existing grid connection and network infrastructure provides some of the fastest possible opportunities to get a big battery system up and running.

Brokhof told RenewEconomy that AGL would be aiming for one to two hours of battery storage at the sites, with the business case of each battery stacking up irrespective of the ultimate fates of the ageing coal and gas generators at the Liddell and Torrens Island sites, respectively.

“We see a high value in batteries with the emergence of renewables given the need for firming infrastructure. There is a clear business case for batteries,” Brokhof said.

“Decision on the Liddell battery has nothing to do with plans for the Liddell power station, this project could be built irrespective of the closure of the Liddell power station.”

Brokhof stressed, however, that AGL recognised the corporate responsibility it had for communities around ageing plants like Liddell, and would work proactively to ensure communities were supported through plant closures.

Additional battery investments will be located at the Sunraysia solar farm, in partnership with Maoneng. AGL is confident that the battery projects will proceed without major issues, despite a series of delays and legal proceedings that hampered the completion of the Sunraysia solar farm.

AGL Energy’s strategy appears to have pivoted away from maintaining a substantial presence in the market for electricity generation and will include a greater focus, albeit with increased investments in battery storage infrastructure.

The new push is being led by Brokhof, how has been recently appointed to lead the company’s ‘Integrated Energy’ division.

“Although energy prices are lower we still see an opportunity to invest as the composition of the portfolio shifts away from coal towards the new firmed renewable generation the market will need. AGL’s strategy is to optimise dispatchable generation, support investment in firmed renewables and continue to invest in the accelerating emergence of batteries and other energy storage technologies,” Brokhof said during AGL’s results update.

AGL currently operates some of Australia’s largest coal fired generators, which are set to close over the next couple of decades, including the Liddell, Baywater and Loy Yang A power stations.

AGL’s financial reports show that the company expects to grow the share of renewables in its generation portfolio, but this is largely driven by coal plant retirements, rather than new investments in renewable energy projects.

AGL established the Powering Australian Renewables Fund (PARF) in 2016, which set a target for 1,000MW of new large-scale renewable generation projects, in partnership with investors QIC.

With this target largely fulfilled, through investments in projects like the 200MW Silverton wind farm and the 453MW Coopers Gap wind farm, it appears AGL may slow its investments in new projects.

Brokhof told RenewEconomy that the company saw customer demand driving the increased uptake for renewable energy, including demand for low carbon energy supplies, but that the company was focusing on securing supplies through power purchase agreements, rather than investing directly in new wind and solar projects.

“Why should we take this risk on our balance sheet? There is enough private investment in new projects, we can deal with them for energy and RECs, rather than taking the investment risk ourselves,” Brokhof said.

AGL will instead continue to offer carbon-neutral or renewable supplies of electricity to its consumers, by securing offtake agreements with projects being developed by others, working as an effective intermediary to secure power purchase agreements.

AGL has undertaken a larger transition towards becoming a more serviced focused business, compared to energy sales, which has included the expansion into data and telecommunications services.

In 2019, AGL acquired regional telecommunications provider Southern Phone Company, and instigated, but subsequently backed out of a move to acquire telco Vocus Group.

AGL reported a 22 per cent fall in earnings for the 2019-20 financial year, driven down by coal plant outages and falling wholesale electricity prices, but was partially offset by growth in its services divisions.