Already Cheaper Than Gas, China’s Renewables to Undercut Coal by 2026

Average solar prices in China have fallen below wind for the first time this year, Wood Mackenzie says.

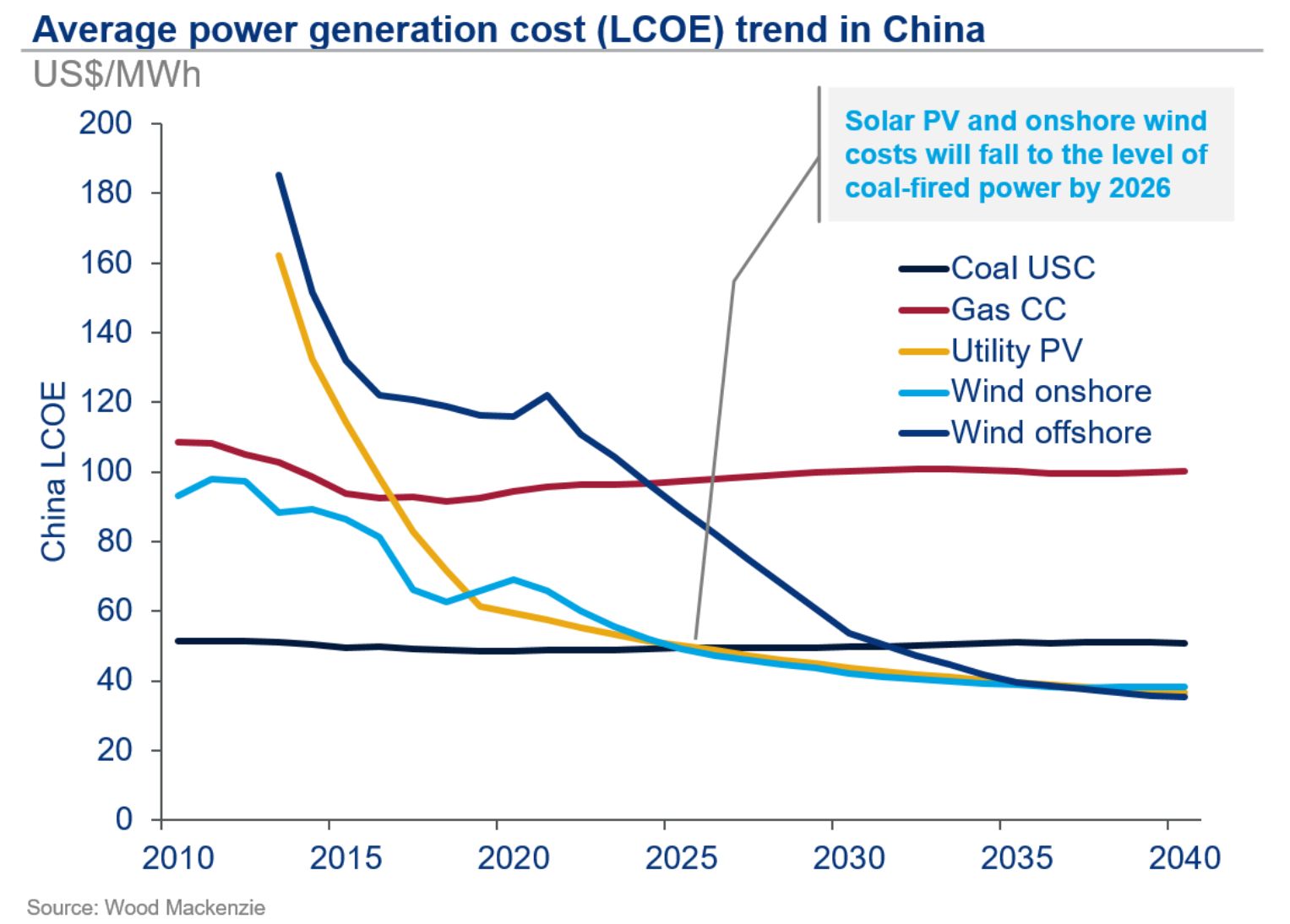

As China moves toward a subsidy-free era for wind and solar projects beginning in 2021, the economics of renewable power have come into the spotlight. The average levelized cost of electricity (LCOE) for solar and wind power is already cheaper than gas-fired power in China, and will be competitive with coal-fired power by 2026, according Wood Mackenzie’s China Provincial Renewables Competitiveness Report 2019.

In 2019, new-build ultra-super critical coal plants are the key conventional low-cost power supply option with an LCOE of below $50 per megawatt-hour, while offshore wind is at the high end of the range, hitting $116 per megawatt-hour.

“Across most of China’s provinces and regions, there is still a renewables cost premium…over coal power, averaging 26 percent in 2019 for wind and solar, down from over 100 percent in 2010,” said Alex Whitworth, research director with Wood Mackenzie Power & Renewables.

“Twenty-eighty of 30 regions examined in our latest report see premiums of up to 70 percent, and only Shanghai and Qinghai have cost-competitive renewables today.”

By 2026, however, WoodMac sees the average cost of renewables falling below the average cost of coal power across China on an LCOE basis.

This year marks the first time when solar PV costs have fallen below those of wind power, overturning the latter’s traditional cost advantage. Today, solar PV is cheaper than wind in 19 provinces, including Qinghai, Gansu, Ningxia and Shaanxi. “We’ve seen solar costs drop in China by nearly 40 percent in the past three years alone, slightly faster than the global average. Technology advancements, government support and expanded scale have contributed to rapidly falling costs,” added Whitworth.

A long slog for some provinces

While renewables will outcompete other resources in much of China within a few years, in other regions the journey will not be a sprint but a marathon — taking a decade or more.

“Wealthier demand centers on the coast and in parts of central and northeast China will be first to see competitive renewables costs. But renewables investment in some areas of northern China, such as Xinjiang, will not be competitive with coal-fired generation, even by 2040,” commented Whitworth.

Cost-competitiveness is not the end of the story. Wind and solar power still only supplied 7.4 percent of the domestic power generation mix in 2018, compared with 83 percent from coal and hydro power. The share of renewables is increasing, but the recently announced renewables subsidy phaseout planned for the end of 2020 threatens the profitability of new investments in renewables in coming years.

Curtailment is also another key issue to deal with in China and creates uncertainty in LCOE modeling in the medium to long term. A 1 percent rise in curtailment typically increases the costs of wind or solar plants by 1.2 percent.

The costs of solar-plus-storage and offshore wind are expected to decline much faster than conventional fuels in the outlook. By 2040, solar-plus-storage costs will range between $33 and $85 per megawatt-hour due to declines in battery costs and economies of scale.

“Offshore will be a key technology for increasing renewables penetration near coastal demand centers. Technology improvement, economies of scale and a high capacity factor are driving costs down. Annual cost declines of 6 percent will make offshore wind competitive with gas by about 2025 and coal by 2032,” added Whitworth.