Burgeoning global electric vehicle market will drive lithium demand over the next five years, says GlobalData

The demand for electric vehicles (EVs), which have emerged as a clean alternative to traditional vehicles, has picked up in the recent years. GlobalData, a leading data and analytics company, forecasts that the demand for lithium, needed for the production of lithium-ion batteries for use in EVs, will more than double from 26.7kt in 2018 to 58.3kt in 2022.

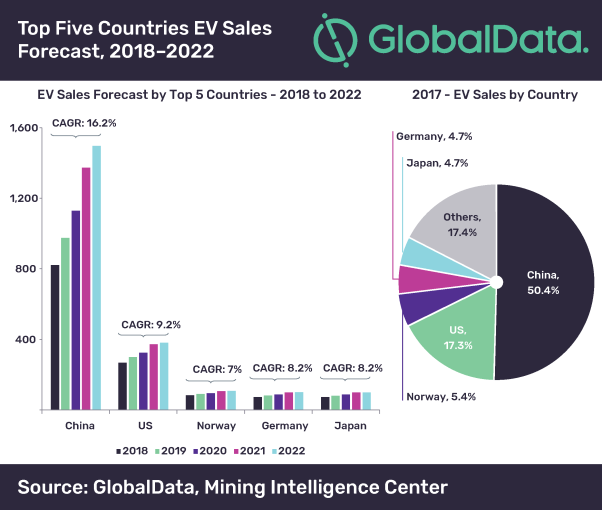

According to GlobalData, the global EV market is expected to grow at a substantial CAGR of 15.6% through to 2022, driven by the growing popularity of EVs across countries in Asia-Pacific (APAC) and Europe. The company further reveals that China will lead the global EV market with more than 50% share and grow three times as fast as the US over the next five years.

This in turn, will result in increased consumption of lithium and support investment in mine expansions across Chile and Australia and new mine development in Chile, Australia, Argentina and Canada.

Vinneth Bajaj, Senior Mining Analyst at GlobalData, commented, “Several national governments are encouraging the adaption of EVs by providing various tax incentives and subsidies to the manufacturers and end users. Additionally, efforts to reduce greenhouse gas emissions have led to much technological advancement in EVs and made them a viable and safe alternative to traditional vehicles.”

In 2017, 1.1 million new EVs were sold globally, of which China accounted for over 50%, followed by the US with 17.3%. In Europe, Norway accounted for 5.4% of global sales, followed by Germany (4.8%) and the UK (4.1%).

Over the next five years, global EV sales are expected to increase to over three million vehicles, primarily driven by APAC and Europe. Meanwhile, EV sales in the US, Norway, Germany and Japan are expected to grow at CAGRs of 9.2%, 7%, 8.2% and 8.2% to reach 380,000, 107,000, 100,000, and 99,000 vehicles, respectively, in 2022. These numbers include battery electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEV).

Bajaj concludes, “The largest increase will be in China, which is expected to boost its EV sales from 579,000 in 2017 to 1.5 million by 2022. Current government policies and subsidies are making China a lucrative market for industry investments due to which the country’s EV market is poised to grow three times as fast as the US during the outlook period.”

Notes to Editors

- Comments provided by Vinneth Bajaj, Senior Analyst at GlobalData

- This report was built using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

Methodology:

GlobalData’s forecasts for EVs are generated based on global and country level historical sales and stocks data from the past 10 years in relation with various policies currently in force across each country.

About Global Data’s Mining Research:

GlobalData’s Mining Intelligence Center is a complete source of mine, commodity, customer and competitor intelligence for the global mining sector. Our service includes an exhaustive mining database covering 29,200+ mine profiles from over 110 mining commodities spread across 150+ countries. We also profile 27,700+ companies, forecast production, demand, imports, exports and prices for 14 key commodities and track the latest mining news.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.