The U.S. Trade Representative said Friday it was eliminating a loophole granted about four months ago for bifacial solar panels, which generate electricity on both sides. They’ll now be subject to the duties Trump announced on imported equipment in early 2018, currently at 25%.

Terms of Trade is a daily newsletter that untangles a world embroiled in trade wars. Sign up here. The Trump administration dealt a fresh blow to renewable energy developers on Friday by stripping away an exemption the industry was counting on to weather the president’s tariffs on imported panels.

The U.S. Trade Representative said Friday it was eliminating a loophole granted about four months ago for bifacial solar panels, which generate electricity on both sides. They’ll now be subject to the duties Trump announced on imported equipment in early 2018, currently at 25%. The change takes effect Oct. 28.

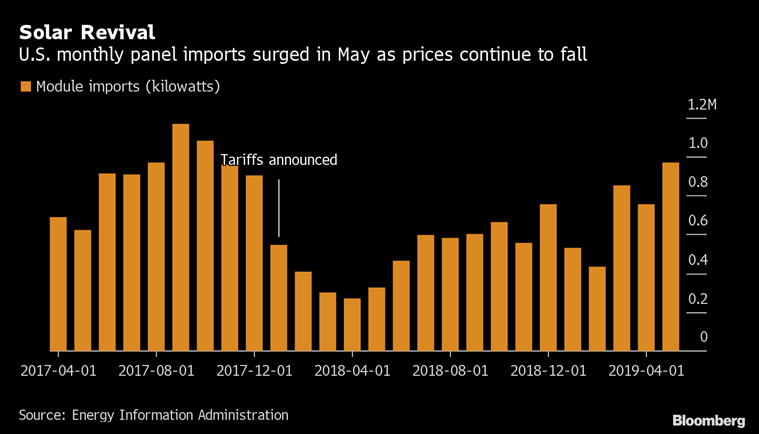

The exclusion had been a reprieve for the solar industry, which lost thousands of jobs and put projects on ice as a result of the tariffs. Some panel manufacturers had already begun shifting supply chains to produce more bifacial panels. Stripping the exemption represents a setback to developers building big U.S. solar projects. American panel makers First Solar Inc. and SunPower Corp. will meanwhile regain an edge on foreign competitors.

“The solar tariffs are back,” Tara Narayanan, an analyst at BloombergNEF, said in an interview Friday. “U.S. solar developers cannot buy products with lower costs and higher output as they briefly thought they could.”

First Solar, the largest U.S. solar panel maker, and SunPower both gained in after-markets trading late Friday.

What BloombergNEF Says

“The withdraw of tariff exemption for bifacial will cool down its popularity in the U.S. a little, but not stop the rise of the technology, which introduces improved economics even without tariff exemption.” — Xiaoting Wang, solar analyst

Developers that have used bifacial panels and stand to take a hit from ending the exclusion include Renewable Energy Systems Americas Inc. and Swinerton Inc.

While bifacial panels accounted for just 3% of the solar market last year, BloombergNEF had projected a swift ramp-up in production as manufacturers tried to insulate themselves from U.S. tariffs.

The trade group Solar Energy Industries Association fought to preserve the exemption, saying bifacial technology held “great promise for creating jobs, right here in America.”

“We’re obviously disappointed,” the group’s general counsel, John Smirnow, said Friday. “We look forward to making sure the bifacial exemption gets a fair hearing” during the solar tariff’s mid-term review process, he said.

The U.S. Trade Representative said in its filing that the exclusion would’ve probably resulted in “significant increases in imports of bifacial solar panels” that would’ve rivaled domestically produced ones.

SunPower, based in San Jose, California, opposed the exemption without a cap, saying that it would otherwise defeat the purpose of the tariffs. “It just means everyone is going to make a bifacial,” the company’s chief executive officer, Tom Werner, said in a Sept. 23 interview.