Battery prices are one of the biggest costs for electric cars, but that cost has plummeted over the past decade.

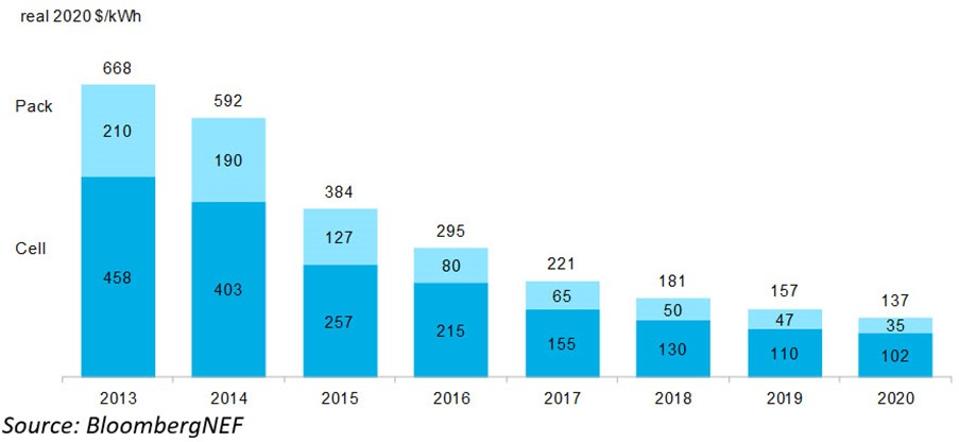

The price of a lithium-ion battery pack has fallen 89% in real terms from more than $1,100/kWh in 2010 to $137/kWh in 2020, according to the latest forecast from BloombergNEF (BNEF). By 2023, average prices will be close to $100/kWh – already prices less than this have been reported for e-bus batteries in China, although the average price was $105/kWh.

This is around the price point that automakers should be able to make and sell mass market EVs at the same price (and with the same margin) as comparable internal combustion vehicles in some markets, and that is assuming no subsidies are available. Actual strategies will vary by automaker and geography.

Prices in 2020 were 13% lower than in 2019, thanks to increasing order sizes, the growth in electric vehicle sales and the introduction of new battery pack designs, according to BNEF’s 2020 Battery Price Survey, which considers passenger EVs, e-buses and commercial EVs as well as stationary storage. New cathode chemistries and falling manufacturing costs will drive prices down in the near term, the research group says.

James Frith, BNEF’s head of energy storage research and lead author of the report, said: “It is a historic milestone to see pack prices of less than $100/kWh reported. Within just a few years we will see the average price in the industry pass this point. What’s more, our analysis shows that even if prices for raw materials were to return to the highs seen in 2018, it would only delay average prices reaching $100/kWh by two years – rather than completely derailing the industry. The industry is becoming increasingly resilient to changing raw material prices, with leading battery manufacturers moving up the value chain and investing in cathode production or even mines.”

Leading battery manufacturers are now enjoying gross margins of up to 20% and their plants are operating at utilization rates over 85%, Frith adds. “Maintaining high utilization rates is key to reducing cell and pack prices,” he says. “If utilization rates are low, then equipment and building depreciation costs are spread over fewer kilowatt-hours of manufactured cells.”

Volume-weighted average pack and cell price split BLOOMBERGNEF

“The increasingly diversified chemistries used in the market result in a wide range of prices, added Daixin Li, a senior energy storage associate at BNEF. “Battery manufacturers are racing to mass-produce higher energy-density batteries with some new chemistries such as lithium nickel manganese cobalt oxide – NMC (9.5.5) – and lithium nickel manganese cobalt aluminum oxide – NMCA – set to be mass-produced as early as 2021.”

The path to achieving $101/kWh by 2023 looks clear, even if there are commodity price increases, the report says. But there is much less certainty on how the industry will reduce prices even further from $100/kWh down to BNEF’s expected price of $58/kWh by 2030. “This is not because it is impossible,” the report states, “but rather that there are several options and paths that could be taken”.

One possible route to achieving these lower prices could be the adoption of solid-state batteries. BloombergNEF expects that these cells could be manufactured at 40% of the cost of current lithium-ion batteries, when produced at scale. They would be cheaper because of savings both in the raw materials and in the cost of production, equipment, as well as the adoption of new high-energy density cathodes. But in order to bring about these reduced prices, the supply chain for key materials, such as solid electrolytes, which are not used in today’s lithium-ion batteries, would have to be established.