Franklin Templeton crisis: Here’s a closer look at the companies in which Franklin has invested in

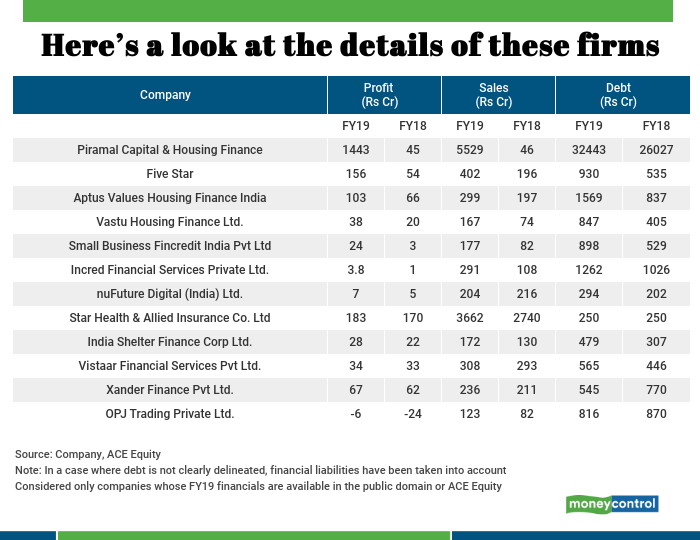

Franklin Templeton’s six schemes have total investments of Rs 7,697 crore to 26 companies (with 100% exposure to the six debt funds) of 88 top borrowers in its six debt schemes

A Moneycontrol analysis of companies that have 100 percent exposure to Franklin Templeton’s six debt funds that were wound up on April 23 shows that many of them do not even have websites or their financial details are not available in public domain.

These companies include Rishanth Wholesale Trading Pvt Ltd, Rivaaz trade Venture Pvt Ltd, Hero Solar energy Pvt Ltd, Aadarshini Real Estate Developers, Hero Wind Energy Pvt Ltd, nuFuture Digital India Ltd, OPJ Trading Pvt Ltd, Xander Finance, RenewWind Energy Delhi Pvt Ltd, Hero Future Energies Pvt Ltd, Future Ideas Company ltd and Essel Infoprojects Ltd.

This doesn’t mean that these companies are mismanaged or have dubious financials. This analysis only attempts to give an insight to the reader to the publicly available financial details of companies as on March 2019.

Franklin has invested in the debt securities of these companies seeking higher returns, compared to the regular debt funds. To repay investors, the fund needs to sell these securities.

Sanjay Sapre, President of Franklin Templeton India had told investors that the company is making all efforts to do that but needs to pay the borrowings first, before investors.

Franklin had highly resorted to borrowings from the banks in the recent past to meet the daily redemption pressure. The lack of demand for lower-rated papers in corporate bond market made things even more difficult.

The firm is in talks with some of these companies to explore the possibility of early repayments, Sapre said. According to B&K Securities report, Franklin Templeton has total investments of Rs 7,697 crore to 26 (with 100% exposure to the six debt funds) of 88 top borrowers in its six debt schemes.

Credit risk funds invest in low-rated papers for higher returns. Santosh Kamath, Franklin’s fund manager, had built a market for credit risk funds by investing in such companies.

Even then, the choice of companies Franklin Templeton chose to invest has come under questions after the fund had to ultimately shut six debt schemes shocking the mutual fund industry.