Executive Summary

This paper outlines the importance of green enterprises in ushering in an era of resilient and sustainable growth. It examines the industries that will propel the Indian economy towards global competitiveness while drawing the country closer to the UN Sustainable Development Goals (SDGs), a development approach that can be called ‘Getting to the Green Frontier’. The paper also highlights how market creation underlies the process of green transformation by demonstrating that market ecosystems are critical for jumpstarting green industries. Finally, it defines the contours of an investment fund (the Green Frontier SuperFund) that can spur the growth of competitive green industries by providing necessary equity and debt financing.

Key conclusions laid out in the paper are:

Businesses become even more important to meet SDGs

Although the SDGs have been embraced by all governments, their success hinges on action and collaboration by all stakeholders, especially businesses. As sustainable business practices gather momentum, companies are likely to play an even more important role in meeting key societal needs, such as healthcare, decarbonisation, clean air and water, waste management, and sustainable food processing and packaging.

Green Frontier SuperFund can be established to invest in scalable high-impact businesses that deliver on SDGs

Many societal needs are best delivered by high-quality companies that are globally competitive and focus on the SDGs. Such Green Frontier firms will ensure that they leverage the most advanced green technologies and embrace the most efficient business models. They are likely to create enduring shareholder value, high-quality jobs, and enable sustainable growth. These industries could include hospitals and acute care clinics, medical technology, life sciences, clean coal, renewable energy, energy efficiency, electric mobility, food processing and packaging, drones, and climate and health financing.

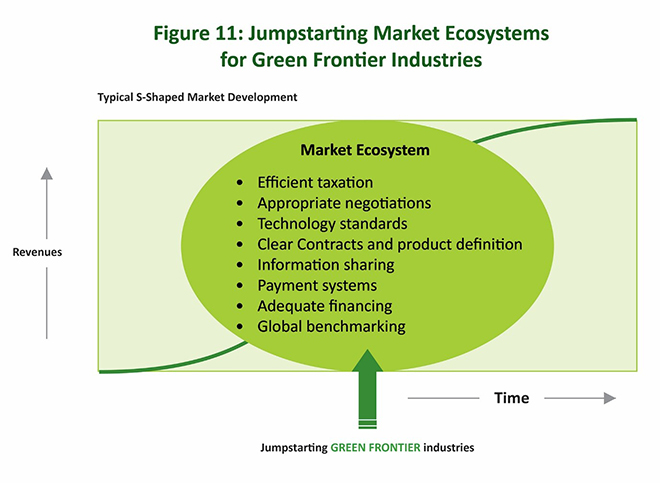

Market ecosystems are critical to jumpstart Green Frontier industries

The sustained success of Green Frontier industries is dependent on a network of supporting factors. Identifying, prioritising and calibrating these institutional elements will help overcome the barriers to market creation. The institutional factors that result in efficient market creation include efficient taxation, appropriate partnerships, technology standards, clear contracts and product definition, information sharing, payment systems, adequate financing, and global benchmarking.

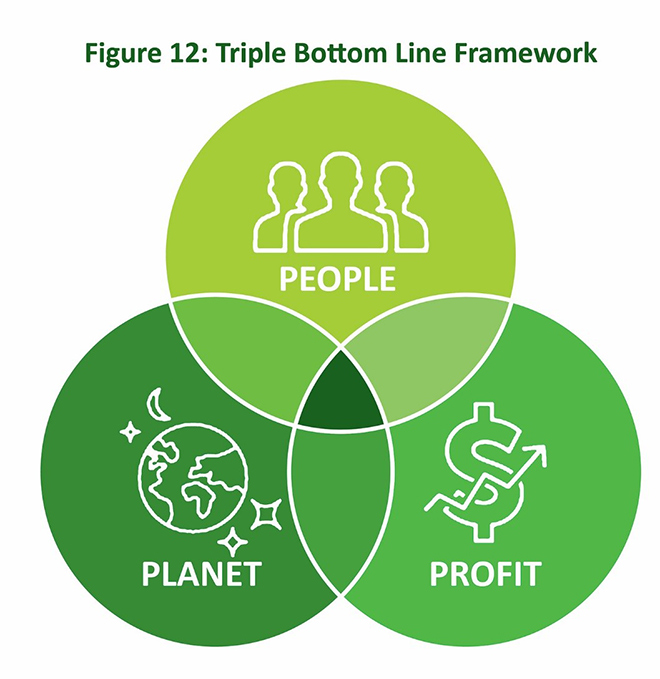

Triple Bottom Line framework to be embedded in the Green Frontier SuperFund’s performance management strategy

The Green Frontier SuperFund will combine a returns-driven strategy with a sustainability focus. The SuperFund will likely comprise multiple different investment funds, with each targeting different aspects of the investment cycle, from an early stage venture fund to a debt fund for expansion financing. The Triple Bottom Line (TBL) framework—emphasising profit, people and the planet—will be at the heart of the Green Frontier SuperFund’s performance management strategy. Institutional investors, such as multilateral organisations, sovereign wealth funds and development financial institutes, will have to come together to create such an institution for India.

First Green Frontier fund sized at US$250 million with sharp focus on long-term investor returns

The first Green Frontier fund could be a growth equity fund that invests ~US$25 million in each company across two or three investment rounds. The investment period will be three to five years, followed by a five-to-seven-year exit period. The Growth Fund could invest growth equity in 15-20 high-quality companies that (1) have proven business models with fast-growing revenues; (2) have highly attractive cash flow with a 20 percent to 30 percent equity internal rate of return; (3) have clear exit pathways; and (4) demonstrate measurable SDG impact. Target dollar returns over the investment cycle could be net 10 percent to 12 percent.

Businesses and the Sustainable Development Goals

The SDGs define sustainable development priorities and aspirations for all countries, and script the global agenda for the development of all societies. Since businesses have been granted a ‘license to operate’ from society, they have also been entrusted with the responsibility of delivering on societal goals. SDGs can act as a bridge that connects business strategies with global priorities and propels them onto transformative pathways. They can provide businesses with an overarching framework for developing strategies that minimise the negative repercussions and maximise positive spillovers on people and the planet. By channelising global public and private investment flows towards the challenges they represent, SDGs can define new markets for businesses to deliver innovative solutions and transformative change.

Traditionally, economists and investors have advocated that the sole purpose of business should be to maximise short-term profits and deliver returns to shareholders. Traditional business strategies analyse ‘where to compete’ and ‘how to compete’ across the global chessboard. Business operations are benchmarked against top global competitors while financial returns are benchmarked against market indices. However, the past decade has seen a growing appetite for sustainable investment within the global investor community. The traditional business rationale has been redefined as a greater number of businesses have aligned their operations with the SDGs.

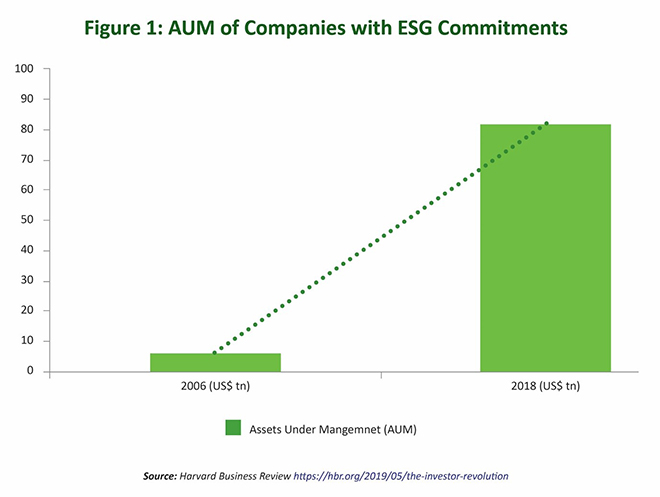

Sustainable investment has gradually evolved and taken on several forms, from philanthropic contributions to more targeted forms such as environmental, social and governance (ESG) investing and impact investing. Impact investments are defined as investments made with the intention to generate positive and measurable social and environmental impact alongside a financial return.[1] Over the past few years, assets under management in ESG funds have grown significantly. In 2006, when the UN-backed Principles for Responsible Investment was launched, 63 investment companies with US$6.5 trillion in assets under management (AUM) signed a commitment to incorporate ESG issues into their investment decisions. By April 2018, the number of signatories had grown to 1,715 and represented US$81.7 trillion in collective AUM.[2]

The traditional view that ESG-investing will entail sacrificing some financial return has long been invalidated.[3] In 2018, Bank of America Merrill Lynch found that firms with a better ESG record than their peers produced higher three-year returns, were more likely to become high-quality stocks, were less likely to have large price declines, and were less likely to go bankrupt.[4] To reap superior financial returns and create long-term societal and environmental gains, an increasing number of businesses have moved to long-term stakeholder value creation as their overriding purpose and fiduciary duty.

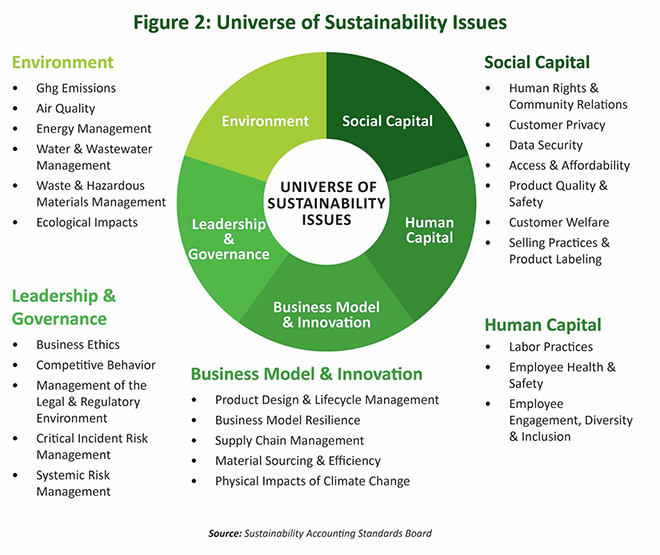

Sustainability metrics can be analysed in an objective and systematic manner. ESG metrics are tracked through the 77 standards established by Sustainability Accounting Standards Board.[5] The board has identified sustainability topics from a set of 26 broadly relevant sustainability issues organised under five sustainability dimensions—environment, social capital, leadership and governance, business model and innovation and human capital.

Green Frontier Industries

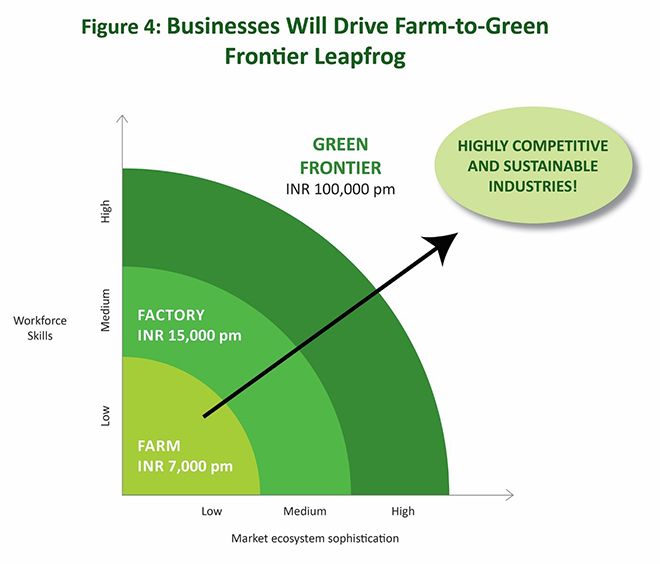

India is set to be the first economy in the world to hit the US$5 trillion mark on a low-carbon pathway.[6] To advance to the Green Frontier, the Indian economy will have to shift from agriculture to resource-efficient, sustainable and globally leading businesses.

The COVID-19 pandemic has put an enormous pressure on the Indian economy’s developmental trajectory. However, large investments in India’s rapidly growing enterprises bear testimony to a growing appetite for the Green Frontier economy as the process of economic recovery gathers momentum. In April and May 2020, Reliance Industries’ Jio Platforms Ltd secured more than US$10 billion in investments from Facebook and private equity firms such as KKR, General Atlantic, Vista Equity Partners and Silver Lake.[7]

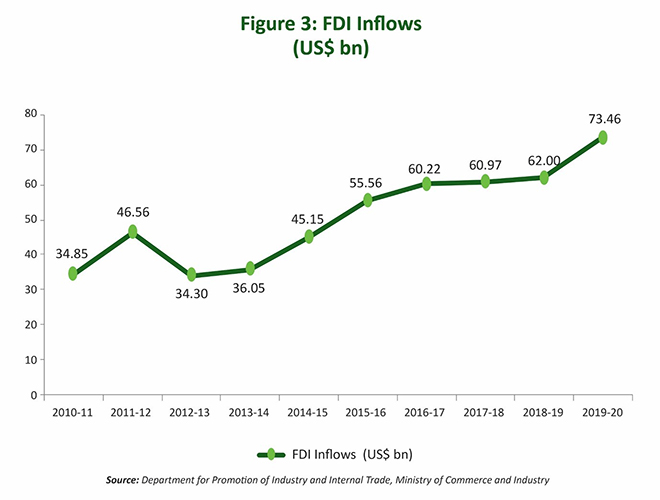

India’s foreign direct investment (FDI) inflows have grown significantly in the last five years, even as trade tensions have precipitated an across-the-board downfall in FDI in other parts of the world. Latest figures from the Ministry of Commerce and Industry show that India received an all-time high record FDI of US$73.46 billion in FY 2019-20, marking an 18 percent jump over the previous year.[8] These investments will serve as an ideal springboard for India to tap into global supply chains, substantially strengthening the possibility of building globally competitive companies in the country.

India’s Green Frontier will be defined by high impact super-competitive industries. Given the country’s scarce natural resources and the global requirement to minimise carbon emissions, these Green Frontier industries will have to ensure that they leverage the most advanced green technologies and embrace the most efficient business models.

Some of the industries that have a high potential to power the Indian economy’s green and sustainable transformation are hospitals and acute care clinics, medical technology, life sciences, clean coal, renewable energy, energy efficiency, electric mobility, food processing and packaging, drones and climate and health financing. More specifically, these industries will accelerate momentum towards achieving SDG-3 (good health and well-being), SDG-7 (affordable and clean energy), SDG-8 (decent work and economic growth), SDG-9 (industry, innovation and infrastructure), SDG-11 (sustainable cities and communities), SDG-12 (responsible consumption and production) and SDG-13 (climate action).

Hospitals and acute care clinics

The COVID-19 crisis has necessitated a new approach towards healthcare institutions and infrastructure. As India deals with the aftershocks of the pandemic, it must mobilise investment to strengthen the country’s healthcare infrastructure and drive economic recovery. COVID-19 has highlighted the need to invest more in public healthcare and build a robust health delivery system, including infrastructure (hospital beds, intensive care units, capacity for elementary procedures) and human resources (doctors, nurses, paramedical staff and medical technicians).

Medical technology

Over the last two decades, technology has revolutionised the way healthcare is delivered worldwide. It has significantly aided patients and providers alike by enhancing the quality of delivery, reducing the turnaround time of workflows and thus the overall cost, and introducing higher accountability into the system.[9] The Indian medical technology industry needs “low-end disruptions”[10] that have the capability to impact a larger segment of the population, especially those who are price conscious and driven by affordability. The effective and innovative use of medical technology, supported by information and communication technologies, has the potential to improve healthcare outcomes by enhancing affordability, accessibility, awareness and availability.

Life sciences industry

The life sciences industry encompasses firms in the fields of biotechnology, pharmaceuticals, biomedical technologies, and life systems technologies. The aftershocks of the COVID-19 pandemic and the increasing threat of chronic illnesses and new disease strains have made it necessary for this industry to grow rapidly to meet societal needs. Increasingly digitised data, such as health and insurance records, genomics, and information on active cases, will benefit from an integrated drug development and manufacturing environment. This will not only improve care facilities for patients but also generate significant revenue for biopharma and medtech companies. To ensure greater transparency, product visibility, traceability and inventory control, digital supply chains will be increasingly used. This infusion of tech will require upscaling skills like probing data, curating information and greater human-machine collaboration, thereby creating entirely new skillsets.

Renewable energy

SDG-7 (affordable and clean energy) is not only important on its own but also bears a crucial link to all other SDGs. India has one of the world’s largest renewable energy expansion plans, having set a target of boosting renewable energy capacity to 175 GW by 2022[11] and 450 GW by 2030.[12] The accelerated deployment of renewable energy can displace climate destabilising fossil fuels from local markets and provide millions of Indians with access to clean and affordable energy, thereby drawing the economy closer to the Green Frontier. This sector will encompass a diverse range of market opportunities offered by solar, wind and biomass sources, energy storage, grid transformation and smart metering.

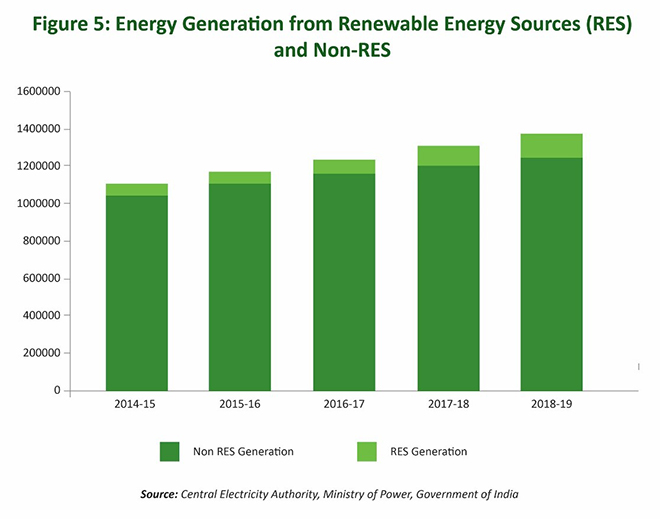

India has aggressively ramped up its renewable energy capacity in the last five years. Capacity increased at an annual growth rate of 17.5 percent between 2014 and 2019,[13] raising the share of renewables in India’s total energy mix from 6 percent to 10 percent.[14] This growth has coincided with a sharp increase in investment in the sector from domestic and foreign sources. The sector has seen more than US$42 billion in investments since 2014 and around US$7 billion of FDI between April 2000 and June 2018.[15]

The Indian renewables industry has evolved significantly over the years and now offers an attractive value proposition to investors. Given its large size, lower risks, predictable yields and medium to high returns, several global funds, such as Singapore-based GIC Holdings, Abu Dhabi Investment Authority, SoftBank and Brookfield, and the private equity arms of Goldman Sachs, JP Morgan and Morgan Stanley, have either entered the sector or are in advanced stages of discussions to invest.[16]

Clean coal

Coal is the highest polluting yet most used fossil fuel for power generation and industrial processes. Clean coal technologies—such as carbon capture and storage, high-efficiency advanced ultra-supercritical steam power plants, supercritical carbon dioxide plants, and the exploration of new combustion and gasification technologies—seek to mitigate the high levels of pollution and other harsh environmental effects associated with the burning of coal. Given India’s high dependence on coal and massive energy requirements, clean coal technologies focus on meeting the near-term needs of the country and set the coal-based power sector on a path to allow it to better respond to future challenges.[17]

Energy efficiency

Investment in energy efficiency is dependent on financing energy efficient infrastructure with a special focus on buildings and lighting. India’s buildings (both residential and commercial) are responsible for around 35 percent of the total energy consumption, with their energy use increasing at an annual rate of 8 percent.[18] As per predictions by the Bureau of Energy Efficiency under the Ministry of Power, India’s constructed floor area will increase by around five times between 2005 and 2030.[19] This unprecedented growth in the building stock presents a potential opportunity for achieving a reduction in energy use in new buildings through energy efficient measures.

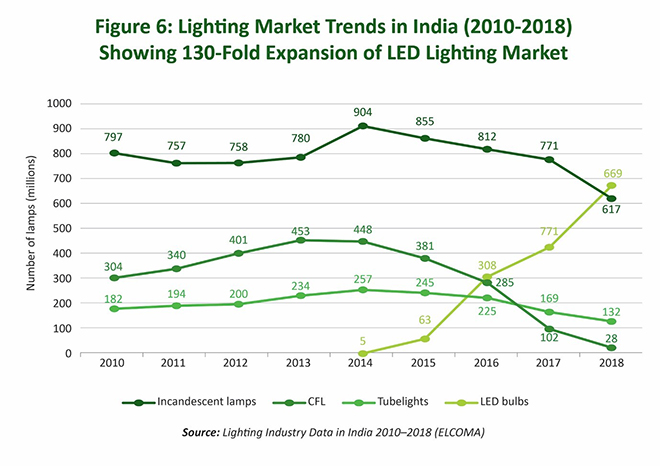

Over the last decade, the Indian lighting industry has been transitioning towards LED lighting technology, which is up to 75 percent more energy efficient than traditional incandescent and compact fluorescent bulbs.[20]India’s LED lighting market grew 130-fold in five years, skyrocketing from annual sales of five million bulbs per year in 2014 to about 670 million in 2018.[21] This resulted in 30 terawatt hours of annual energy savings—roughly enough to power 28 million average Indian households or the whole of Denmark for a year.[22]

The main driver of India’s rapid market creation was the ‘Unnat Jyoti by Affordable LEDs for All’, or UJALA, policy initiative that procured LED bulbs for the national market. Such strategic policy efforts play an important role in creating markets for cutting-edge low-carbon and energy efficient technologies.

Electric mobility

Emerging trends in the Indian policy landscape offer a great opportunity for the accelerated adoption of electric vehicles (EVs), including cars, bikes, buses and e-rickshaws. The Ministry of Heavy Industries has shortlisted 11 cities for the introduction of EVs in their public transport systems under the Faster Adoption and Manufacturing of (Hybrid) and EVs in India, or FAME, scheme. It has also approved the FAME-II scheme with a fund requirement US$1.39 billion for 2020–22.[23] Another important policy is the National Electric Mobility Mission Plan 2020 launched by the National Mission for Electric Mobility with the aim of investing up to INR 140 billion in the next eight years for the development of electric infrastructure. A policy regime well-aligned with a sustainable mobility paradigm, a relative abundance of exploitable renewable energy resources and a high availability of skilled manpower will create the perfect blend of investment opportunities for India’s electric mobility industry.

Food processing and packaging

India is one of the top five markets for packaged food in the world, and the second largest in Asia.[24] The previous decade witnessed a disruption in global and domestic food processing and packaging markets due to a host of factors, including changes in industrial trends, retailing practices, consumer behaviour, food safety standards and environmental waste considerations. The trend towards intelligent processing and packaging has been gaining traction in Indian markets as it helps prolong shelf life, improves food safety, and minimises food waste. Sustainable processing and packaging aim to minimise the environmental impact and ecological footprint throughout a product’s lifecycle. The expansion of the sustainable food processing and packaging industry would allow the Indian economy to start to develop a circular economy ensuring that packaging comes back to its source to be safely recycled. This will also contribute to the overall decrease of food losses and persistent plastic accumulation.

Drones

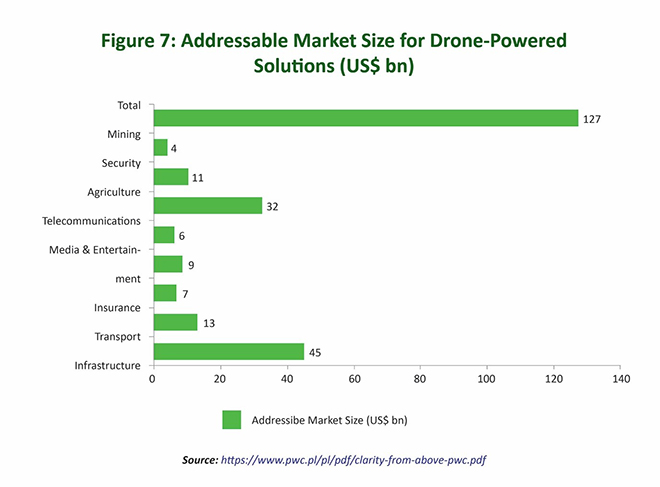

Drones or unmanned aerial vehicles (UAVs) are being used in a variety of creative ways to advance the SDGs. The total addressable value of drone-powered solutions in all applicable industries is estimated at over US$127 billion.[25] The industry with the best prospects for drone applications is infrastructure, with a total addressable value of just over US$45 billion.

Drones have been used to deliver aid and essentials in time of conflict and crisis, enabling the delivery of life-saving aid like medicines and food to remote areas in a quicker and more affordable manner. For instance, drones manufactured by Zipline, a San Francisco-based robotics company, have been used extensively in Rwanda to provide doctors with instant access to vaccines and blood supplies.[26] Their rapid response time and ability to deliver even the rarest blood types has helped Rwanda make massive strides in reducing maternal mortality rates.[27]

The data and images captured by drones are used to develop safer routes for disaster response teams. Drones can also be used for surveillance purposes as they can transmit video and images in real time. Surveillance drones have been deployed by the United Nations to assist peacekeeping operations in Mali and in Central African Republic.[28]

Drones are currently being used by the Indian government to monitor the spread of COVID-19 and ensure social distancing is maintained.[29] India has also used drones to locate victims of natural disasters, to check for illegal mining and pilferage and for 3D mapping.[30]

Climate and health financing

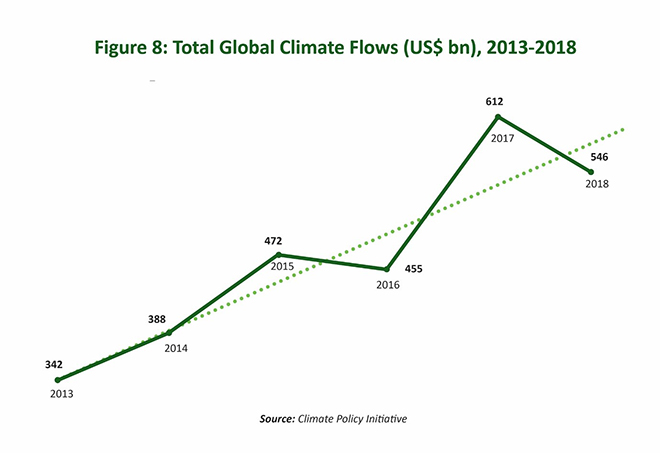

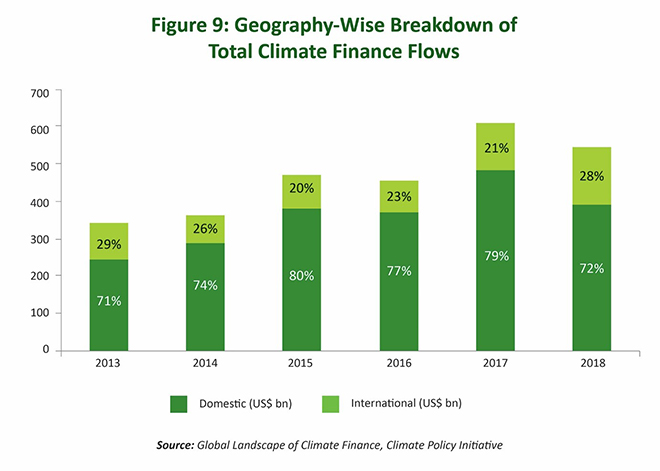

Climate finance flows reached a record high of US$612 billion in 2017, driven particularly by renewable energy capacity additions in China, the US and India, as well as increased public commitments to land use and energy efficiency.[31]

A geography-wise breakup of the total climate flows reveals a strong domestic preference, with 72 percent of climate finance being raised and spent domestically in 2018.[32] While the share of domestic finance in total climate finance has declined from 79 percent in 2017,[33] the statistics highlight the need to establish better enabling environments for climate finance, and enhance international cooperation to facilitate flow of funds across countries and regions.

While climate finance has reached record levels, annual investment must increase many times over, and rapidly, to achieve a truly systemic green transformation. The total preliminary estimates for meeting India’s nationally determined contributions between 2015 and 2030 are US$2.5 trillion (at 2014-15 prices).[34] This requires unprecedented collaboration between the government, regulators, development banks and private investors to align all financing with climate goals and SDGs.

In a similar vein, health financing is increasingly being recognised as an area of major policy relevance in India. In 2018, India launched the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana, the world’s largest and fully state sponsored health assurance scheme that covers a population of the combined size of the US, Mexico and Canada.

Jumpstarting Market Ecosystems for Green Frontier Industries

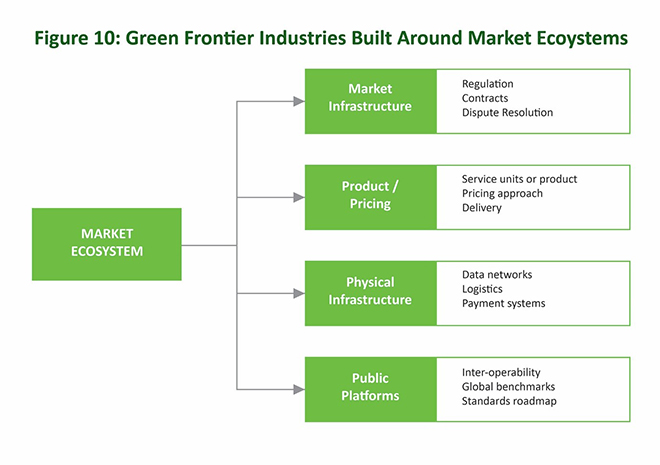

A robust and efficient market ecosystem will play a pivotal role in facilitating the growth of green industries. It will drive the economy closer to the Green Frontier by spurring cost-effective and innovative solutions, harnessing the entrepreneurial spirit, and catalysing impact. A market ecosystem typically comprises of four interdependent pillars—market infrastructure, product and pricing features, physical infrastructure, and public platforms.

The sustained success of Green Frontier industries is dependent on a network of supporting factors, including efficient taxation, appropriate negotiations, technology standards, clear contracts and product definition, information sharing, payment systems, adequate financing and global benchmarking.Identifying, prioritising and delivering these essential elements will help overcome the systemic impediments to a thriving market.

Efficient taxation: The competitiveness and growth of Green Frontier industries will hinge on an efficient system of taxation that strikes a balance between optimising revenue and stimulating industrial activity.

Appropriate partnerships: Business alliances and joint ventures that thrive on goodwill last far longer than those based on adversarial competitiveness. A shift to strategic discussions committed to achieving common goals (win-win) through compromise, clarity and information sharing is preferred. Negotiations help foster proficient communication and greater confidence when engaging with peers and clients.

Technology standards: They will help level the playing field for Green Frontier industries and encourage collaborative innovation. They will enable compatibility between different components of the ecosystem, thereby creating a positive impact on consumer choice and sector development.

Clear contracts and product definitions: Clear and precise contracts are essential to give effect to the objectively expressed intent of all parties. It is important to consider the interplay between definitions and foresee impacts on fulfilling the terms of a contract. Contracts lacking clarity and definitional precision are likely to devolve into disputes, resolving which would be an expensive and long-drawn process.

Information sharing: A shift towards sharing rather than guarding information is essential for innovation and market creation. Decisions made on inaccurate or unreliable data can have dire consequences. Information sharing within the market ecosystem is essential to deliver efficient, coordinated and individualised services in a time and cost-effective manner. Transparency promotes trust; a careful shift towards the free flow of information and ensuring data integrity is necessary.

Payment system: A strong and well-developed payment system speaks to the sophistication of the finance, communication and technology platforms in operation. A well-honed mechanism of moving money represents an infinite potential for job growth, facilitates secure transfer across borders, and underpins the exchange of all services essential for maintaining order.

Adequate finance: This will spur new businesses and enable existing ventures to continue their operations uninterrupted without financial stringency and strain. The market ecosystem must map out the sources of additional financing and the viability of receiving it for businesses facing shortfalls.

Global benchmarking: This offers a concrete way for organisations to understand competitive positioning and monitor the marketplace. There is now a wealth of data available that makes tracking, measuring and comparing performances accessible. Instilling the process of seeking best practices, implementing innovative ideas, and inculcating effective operating strategies leads to superior performances across sectors.

The Green Frontier SuperFund

The Green Frontier SuperFund will be established with the purpose of accelerating investment in Green Frontier industries, with the understanding that sustainability and ESG considerations are core drivers of stellar investment performance and positive economic change. The primary mandate of the SuperFund will be to create and spur the growth of green markets across all sectors of the economy. The SuperFund will combine a returns-driven strategy with a sustainability focus to fully capitalise on a prospective investment’s impact, sustainability value and resource efficiency potential. The TBL framework, with an emphasis on profit, people and the planet, will be at the heart of the SuperFund’s performance management strategy.

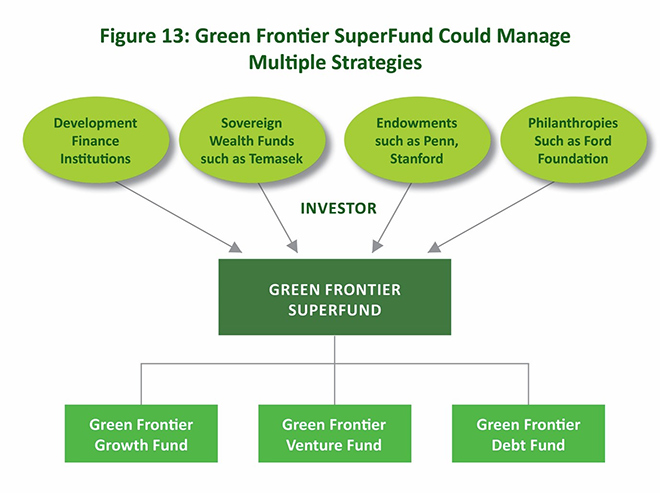

The SuperFund will comprise multiple different investment strategies. Each of these strategies will be targeted at different aspects of the investment cycle. For example, an early stage venture fund will provide start-up financing for promising entrepreneurial teams. Growth capital to fast-growing companies with proven business models could be provided through a growth equity fund. A debt financing fund could be used to finance expansion plans for strong, fast-growing companies. Structured vehicles could also be created to provide one-off financing for large-scale plant expansion or retrofit projects such as a pithead coal gasification plant.

The Green Frontier SuperFund could thus comprise of three core funds—Growth Fund, Venture Fund and Debt Fund—which will be leveraged to finance a wide spectrum of Green Frontier industries across different stages of the investment cycle.

The Green Frontier SuperFund could start with an initial growth equity fund sized at US$250 million. The initial capital for this growth equity fund could be mobilised from a diverse range of investors, including specialised development organisations such as development finance institutions, sovereign wealth funds (such as Temasek Holdings), university endowments (such as the Stanford Endowment) and philanthropies (such as the Ford Foundation).

Green Frontier Venture Fund (Seed and A rounds): This will be an early stage venture capital fund focussed on launching high-potential sustainability ventures across the country. It will engage with entrepreneurs at the early stage to identify and develop novel ways to deploy these ventures at scale, leveraging new innovations in technology, financing, design and marketing. This fund would provide upcoming ventures with a unique ecosystem of ideas, offering exclusive access to technical expertise, potential partners, market channels and opportunities.

Green Frontier Growth Fund: This will be utilised to fund relatively more mature ESG-focussed companies looking for capital to expand or restructure operations. Established, high-impact firms that wish to offer a new range of solutions or enter new markets will also be considered. It will focus on ventures with rapidly growing revenues and positive cashflows that exhibit a promise to steadily approach profitability in the near future. The growth fund’s mandate would be to mobilise funds for ventures that can generate lucrative financial returns, create a massive social impact and power the country’s green transformation. Due to the COVID-19 pandemic and the associated economic contraction, a host of promising ventures are likely to face a capital crunch. The growth fund could invest in some of these ventures to ensure their revival and scale-up.

Green Frontier Debt Fund: This will provide debt financing for ESG bonds issued by large firms and institutions. These bonds will allow this fund to invest in sustainable solutions, such as renewable energy, energy efficiency, sustainable waste management, clean transport, biodiversity conservation and water management, through a range of high-quality fixed income products. This will enable the fund to tap into the diverse opportunities provided by the sustainable economy while reaping high financial returns.

Overview of the SuperFund’s Investment Process

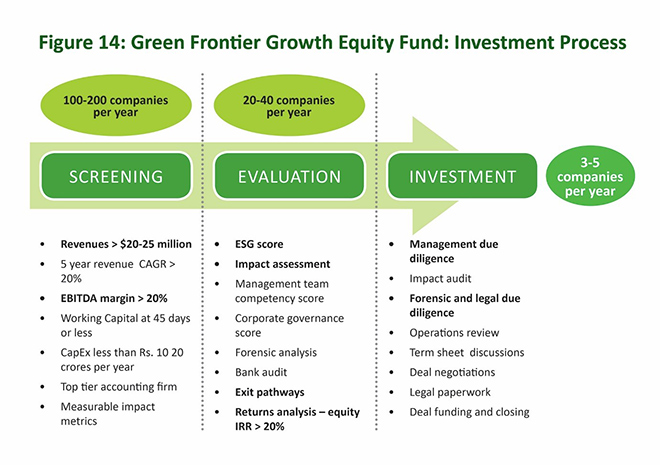

The Green SuperFund will integrate ESG concerns into the fundamental investment analysis of the opportunities in its investible universe. To illustrate this process, consider how the Growth Fund could operate. A three-step procedure will be followed to finalise companies that this fund will invest in.

Screening: The Growth Fund will fund relatively more mature ESG-focussed companies looking to expand, restructure operations or enter new markets. The fund will examine 100-200 companies every year as a part of the screening process. Companies with a revenue stream of over US$20-25 million, five-year revenue CAGR[a] higher than 20 percent and an EBITDA[b] margin greater than 20 percent will be considered. Such companies must also have a 45-day working capital and a CapEx[c] of less than INR 10-20 crore per year.

Evaluation: After undergoing the screening process, a group of 20-40 companies will be considered for a rigorous, in-depth evaluation. To ensure a transparent and objective evaluation, companies will be assessed based on their ESG score, management team competency score and corporate governance score. While conducting the due diligence, a special emphasis will be laid on the value proposition and risk assessment of ESG-related factors. Forensic analysis, returns analysis (equity IRR > 20 percent) and bank audit will also be conducted. Upon exit, if any remaining ESG concerns remain active, the SuperFund will highlight these to the buyer.

Investment: Post the evaluation stage, three to five companies will be finalised for investment each year. The deal will be presented before the Investment Committee, and the assessment and findings from the ESG due diligence will be discussed. An ESG Risk Assessment and Sustainable Impact Assessment will also be conducted to ascertain the company’s ESG value creation. This will be followed by forensic and legal due diligence.

The investment team will then review the operating procedures, profitability issues, communication channels and other factors that might affect the stability of the business. This will be followed by term sheet discussions, in which the parties involved will set forth the basic terms and conditions under which the investment will be made. These discussions will serve as a template to develop more detailed legally binding documents. Once the documentation for the investment is finalised by the investment team and the respective company, the deal will be funded and closed.

Management Structure of the Green SuperFund

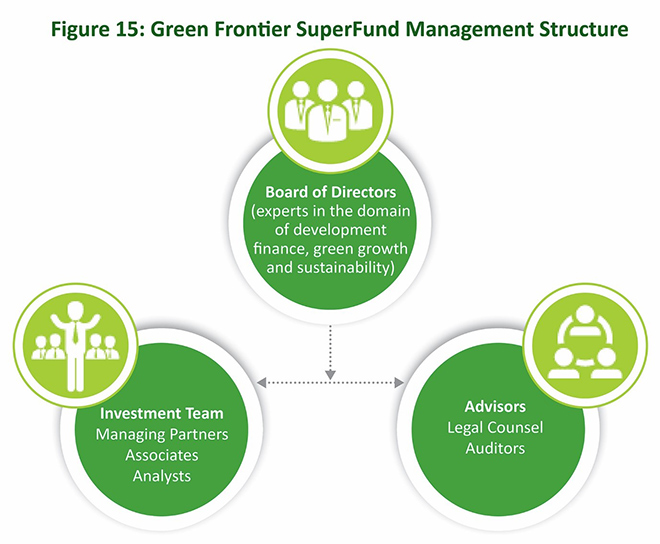

The Green Frontier SuperFund will favour a matrixed organisational structure to facilitate multiple investments of various sizes and complexities simultaneously. This structure allows for seamless integration, encourages better communication, and aids information sharing between teams to make a collaborative and dynamic organisation. Each SuperFund strategy will have its own investment team, which will be structured in the following manner.

Investment team

Each fund will be headed by a pair of partners who will be responsible for guiding its strategic direction in accordance with its mandate. They will focus on maintaining positive client relationships and driving new acquisitions. Additionally, they will have designated control over day-to-day operations.

This investment team will also include four to six associates who will be responsible for implementing the fund’s investment strategy and managing its portfolio activities. Through their research, they will determine the investments, companies and clients that best further the TBL framework. To motivate performance, a share of the fund’s profits will serve as compensation for associates when it meets or exceeds a pre-determined threshold level. This carried interest will serve to incentivise performances across the team.

A network of financial and accounting professionals will support the work of partners and associates. These analysts will research economic conditions, companies and market trends to provide business, sector and industry recommendations. The accountants will be responsible for maintaining up-to-date and accurate financial records, including ways to reduce costs, enhance revenue and improve profits.

Board of directors

The board will comprise key individuals who are appointed or elected based on their expertise in the areas of prime relevance to the management of the fund—green growth, sustainability, development finance. The board will assist in setting, supporting and executing goals in line with the primary mandate. Board members will have a fiduciary responsibility to manage funds in the best interest of all stakeholders.

Additional advisors

The fund will also benefit from having an in-house legal counsel to advise on the legality and risks of day-to-day decisions. External lawyers will be approached for any discussions, deals or partnerships between the fund and a third party. The in-house audit department will review routine activities and provide suggestions to increase operational efficiency. Lastly, external auditors will attest to the accuracy and truthfulness of all financial statements provided by the fund during the annual audit mandated under the Indian Companies Act 1956.