Global Energy Perspective 2021

The Global Energy Perspective describes our view on how the energy transition can unfold, through four scenarios.

remains uncertain.

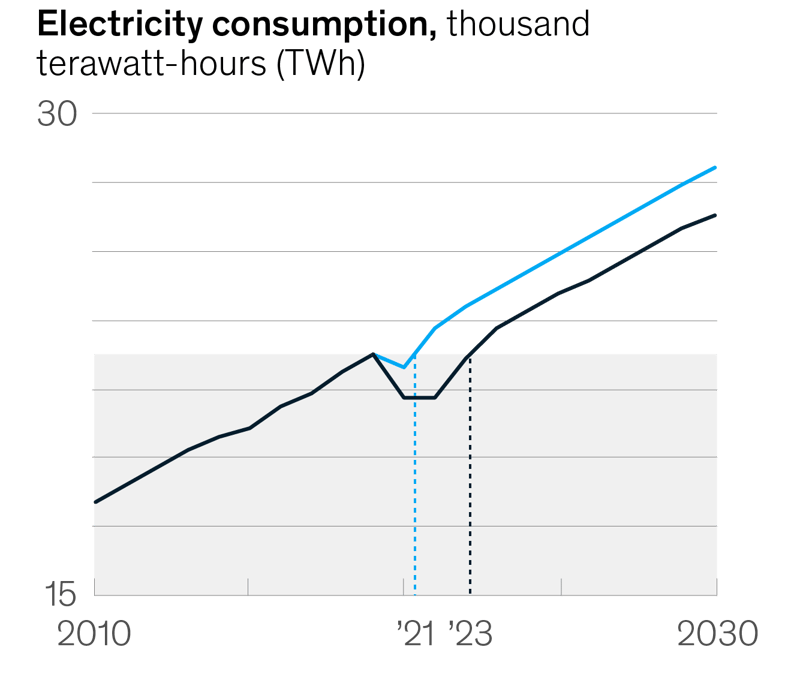

At the same time, the world’s energy systems are going through rapid transitions that are triggered by simultaneous shifts in technological development, regulations, consumer preferences, and investor sentiments. Our Reference Case sheds light on these developments and provides a synthesis on how energy demand will evolve.

Recent work by McKinsey on the effects of the COVID-19 crisis on economic growth introduces a set of scenarios, reflecting varying levels of effectiveness of the public-health response and speed and strength of policy interventions.

From these scenarios, two were selected as most likely outcomes by a group of more than 2,000 executive respondents globally: “Virus Contained; growth returns” and “Muted Recovery.” At the time of this report’s publication

(January 2021), the latest actual numbers show a trajectory that comes closest to “Virus Contained; growth returns.” Consequently, this scenario underlies the projections in our report.

Peaks in fossil-fuel demand keep coming closer

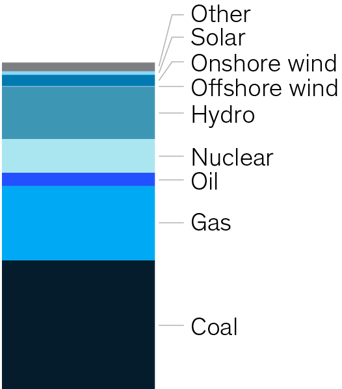

Projected peaks in demand for hydrocarbons have come forward. Oil demand peaks in 2029 and gas in 2037, whereas coal shows a steady decline.

Yet in the Reference Case fossil fuels continue to play a major role in the energy system by 2050, driven by growth in areas such as chemicals and aviation.

In the Accelerated Transition scenario, demand for fossil fuels continues to decline, particularly oil and coal. Peak oil demand could move forward by five years to the early 2020s, at a level less than 1 MMB/D above 2019 levels.

Summary: