Government to float tender for gravity storage; foreign firms keen on prospects

India is planning to float a tender for setting up gravity storage plants, inviting firms with mechanical storage expertise to bid for it. International gravity-based storage companies like EnergyVault, Gravitricity and Gravity Storage Inc have already shown interest.

New Delhi: The Ministry of New and Renewable Energy (MNRE) is planning to float a tender inviting companies to set up gravity storage plants in India, a senior ministry official told ETEnergyworld.

A traditional gravity-storage technology for energy storage involves storing potential energy by lifting a large mass of concrete using hydraulic pressure. Electricity is generated by dropping the mass which pushes a large volume of water through a turbine enabling it to rotate.

Earlier this month, MNRE published a notification on its website inviting preliminary project proposals on gravity storage. The notification was later withdrawn from the website. The official said the earlier notification was aimed at inviting research and development proposals.

“Since it is a well-established technology and there is no need for much research and development, we are planning to come up with a proper tender for gravity storage very soon and anyone with mechanical storage expertise can bid for this tender,” he told ETEnergyworld, asking not to be identified.

India is planning to ramp up its installed renewable energy generation capacity from the current 79,000 Mw to 175,000 MW by 2022. The intermittent nature of solar and wind energy have fueled the need for reliable storage systems.

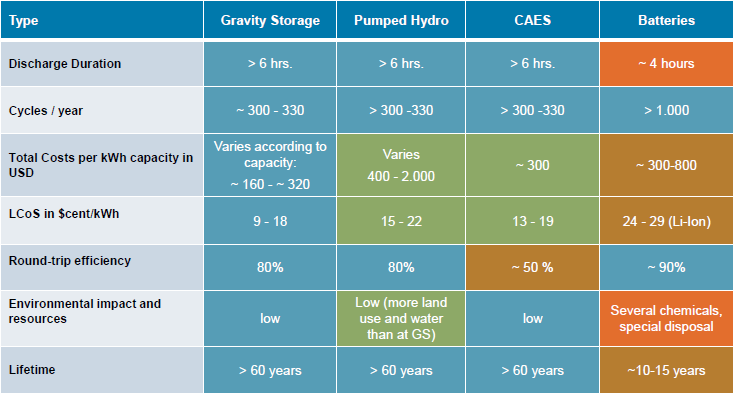

The energy storage sector in India has traditionally been dominated by pumped-hydro power (PHP) systems where water is pumped and stored at an elevated reservoir. It is then released for generating electricity. Pump storage is a type of gravity storage where water is moved from the upper reservoir to lower reservoir.

India has an installed pumped-hydro power generating capacity of around 5,000 Mw while only around a half of it is operational. These systems typically suffer from issues of land availability and environmental clearance. Other similar storage technologies, like the one that uses movement of large concrete blocks to propel turbines, are currently at the discussion stage globally.

“Gravity storage is still under commercialization even in other countries. So, we need to wait and see its performance. Although with simulation and modelling it has shown good performance,” said Rahul Walawalkar, executive director at industry body India Energy Storage Alliance (IESA).

India is poised to become a lucrative market for energy storage on the back of the recent fast transition towards renewables. A few international gravity-based storage firms are already eyeing opportunities in the South Asia region, mainly India, to establish their demonstration plants.

Switzerland-based energy firm Energy Vault announced an agreement with India’s Tata Power in November last year to deploy its 35 Megawatt-Hour (MwH) gravity-based energy system by 2019.

Energy Vault’s CEO and co-founder Robert Piconi believes India can be a very attractive market given the rapid deployment of renewables and the need for a longer duration of utility-scale storage to solve issues related to intermittency of wind and solar.

“The response from the market in India to Energy Vault’s solution has been very strong since we announced the commercial availability of our technology. We have plans to do additional projects here as soon as deployments get into the field phases,” Piconi told ETEnergyworld.

Commenting on how Energy Vault’s system is different from other gravity storage models, Piconi said: “Our solution does not require a specific land topography, pre-existing structures like mine shafts or underground geology. We can also use waste debris materials like concrete debris, coal ash, high metal content soils that would otherwise have to be landfilled at very high costs and can have a negative impact on the environment.”

He also claimed that the Levelized Cost of Electricity (LCoE) in the case of Energy Vault’s system works out to around 2-4 cents per Kilowatt Hour, the lowest in the world, making it a perfect solution for India. “When added to the cost of solar Photovoltaic (PV) that is around US$ 0.02-0.03 cents per kWh, you have a total levelised cost of energy of US$ 0.05-0.06 per kWh, which enables you to beat existing and fully amortized fossil fuel plants for the first time.”

Another company, US-based Gravity Storage Inc, is currently looking for partners to plan and construct a demonstration plant in order to prove the concept‘s viability. “We are looking for partners, locations, and funding for a demonstration plant in one of our key markets – India, USA, China and the Middle East,” CEO Robert Werner said.

He also said that setting up the demonstration plant will cost around the US$ 10 million for which the company will need government funding. The earliest time for commissioning a demonstrator is 2021 as it takes one year of planning, and one year will be needed for its construction. In the next phase, Werner plans to set up a commercial storage plant of 1-10 GwH capacity at a cost of around $300 million. He said the company is willing to introduce the concept to India and is currently in talks with private companies.

Another company Gravitricity, a UK-based firm that uses rotatory winches instead of hydraulics to store energy, is planning to prove its technology over the next five years while the real expansion will happen only after 2025.

“We lift very heavy weights using electrically-driven winches in underground shafts to charge the system, then lower those weights to discharge, with the motors running as generators. The system uses the same physics as pumped hydro energy storage but instead of using hydraulics we use the direct rotary drive of a winch and cable,” Charlie Blair, managing director, Gravitricity, told ETEnergyworld.

Blair said that India is a very important geography for mechanical energy storage. “In countries like India, where the grid is expanding, it (the technology) will be built into electricity grids as a part of the infrastructure. Our technology will last more than 50 years, and will have a life cycle of 10 or 100 times as compared to that of lithium-ion batteries,” he added.

Experts believe that the fast decline in the solar and wind energy costs in India and the exponential rise in storage needs will make the deployment of cost-effective bulk storage systems essential. The global energy storage market is expected to grow to a cumulative 942 GW or 2,857 GWh by 2040, attracting $620 billion in investment over the next 22 years, according to research firm Bloomberg New Energy Finance.