India’s $28 Billion of Green Bonds Are Under the Spotlight

0

0

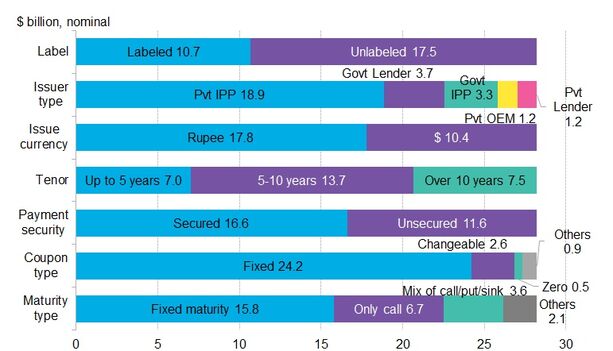

India’s green bond issuers have preferred rupee denominated unlabeled issues. The majority of bonds have fixed coupon rates which can be serviced from the steady cash flow of renewable energy projects. Bond tenors vary from six months to over 30 years, with five- to 10-year tenor being most common. The privately-owned power producers have led the way both in terms of the amounts raised and in offering issues with call options that allow for early redemption. Read More…

Related posts:

- MNRE revises benchmark cost of Concentrating Solar Thermal (CST) Technologies

- Andhra Pradesh:Status Of Renewable Energy Power Projects Commissioned In Andhra Pradesh State As On 31.12.2015

- Substantially reducing emission intensity of GDP: India

- Jamia Millia Islamia to set up solar power plant on its own campus

tags:

Green Bonds