These companies are closely followed by Azure Power with 1,591 Mw, Tata Power with 1,388 Mw, Renew Power with 1,241 Mw, NTPC 870 Mw Avaada Power 680 Mw, Hero Future Energies 553 Mw and NLC with 440 Mw of capacity

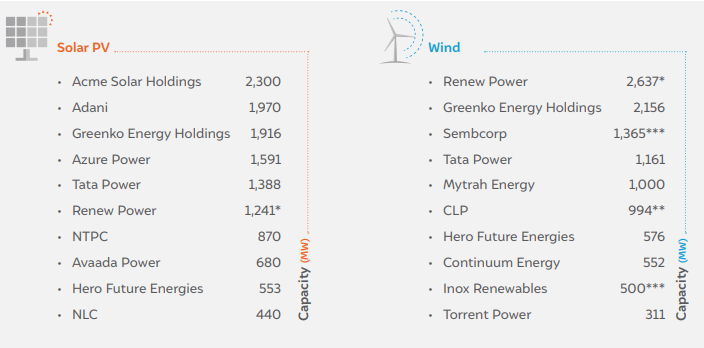

New Delhi: Acme Solar, Adani, and Greenko have topped the list of India’s largest solar power producers by capacity while in the wind energy sector Renew Power, Greenko and Sembcorp top the charts, according to latest data compiled by the International Energy Agency and CEEW.

The latest data, compiled in a report “Clean Energy Investment Trends 2019”, shows Acme Solar Holdings had 2,300 Megawatt (Mw), Adani 1,970 Mw while Greenko Energy Holdings had 1,916 Mw of solar PV generation capacity at the end of May 2019.

These companies are closely followed by Azure Power with 1,591 Mw, Tata Powerwith 1,388 Mw, Renew Power with 1,241 Mw, NTPC 870 Mw Avaada Power 680 Mw, Hero Future Energies 553 Mw and NLC with 440 Mw of capacity.

India’s largest renewable energy companies:

In the wind energy sector, among the top three developers, Renew Power had 2,637 Mw, Greenko Energy had 2,156 Mw and Sembcorp had 1,365 Mw of generation capacity at the end of May 2019.

These companies were followed by Tata Power with 1,161 Mw, Mytrah Energy with 1,000 Mw, CLP with 994 Mw, Hero Future Energies 576 Mw, Continuum Energy 552 Mw, Inox Renewables 500 Mw and Torrent Power with 311 Mw of capacity.

The report clarified that the installed capacity figures for Renew Power pertain to March 2018. As of May 2019, the company had 4.3 GW of combined solar PV and wind installed capacity, but the split between wind and solar PV was not available.

Similarly, the figure for CLP does not include a 100 MW wind project in which it holds a 49 per cent equity stake. Also, the figure for Inox Renewables is estimated assuming commissioning of projects won in tenders in 2017. The company divested its pre-existing portfolio of 260 Mw in March 2017.

Overall, the report highlights that the investment in India’s renewable energy sector has doubled over the past five years. At around $20 billion in 2018, it has surpassed capital expenditure in the thermal power sector.

“Ambitious targets, supportive policies, and falling technology costs have improved the attractiveness of financing utility-scale solar PV and wind projects, spurring a dramatic expansion in deployment, though with some differences in the risk profiles and industry landscape between the sectors,” the report states.

The researchers analysed utility-scale solar PV and wind projects sanctioned between 2014 and 2018 to highlight higher market concentration, better financing terms and lower investment risks over time. However, financing constraints and uncertainties over key policy and infrastructure enablers remain present.