PTC India is promoted by stateowned power utilities NTCP, Power Finance Corporation, NHPC and Power Grid Corporation of India.

New Delhi: PTC India, the nation’s top power trading company, is in negotiations with potential suitors to sell two subsidiaries — nonbank lender PTC Financial Services and renewable energy firm PTC Energy, two people involved in the process said.

“The move is aimed at raising Rs 1,500-2,000 crore besides exiting from non-core businesses,” said one of the people, speaking on the condition of anonymity. “The company is looking at selling the entire stake or at least a majority so as to maximise the valuation of its investment,” he added.

PTC India is promoted by stateowned power utilities NTCP, Power Finance Corporation, NHPC and Power Grid Corporation of India.

It owns 65% in the listed PTC India Financial Services (PFS).

Wholly-owned subsidiary PTC Energy has a portfolio of 289 MW.

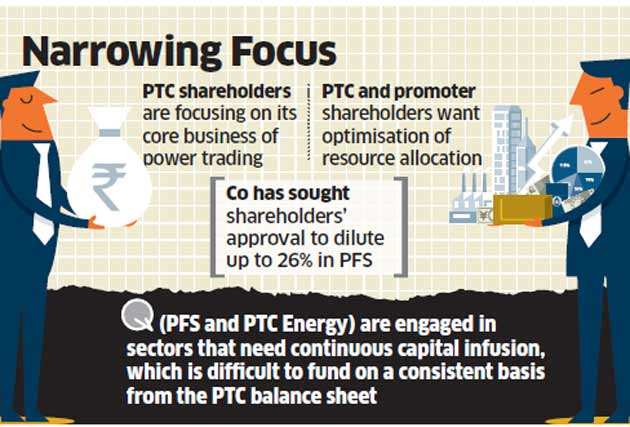

The company’s shareholders are focusing on its core business of power trading and exiting non-core businesses, a company spokesperson said. PTC has sought shareholders’ approval for the share sale.

PTC decided to exit both businesses because its shareholders, as well as those of its promoters, have been demanding optimisation of resource allocation, people said.

“Over the period, PTC has invested about Rs 1,400 crore in these companies.

These two companies are engaged in the sectors that need continuous capital infusion, which is difficult to fund on a consistent basis from the PTC balance sheet,” said the second person.

PTC has sought shareholders’ approval to dilute up to a 26% stake in the financial services firm from the current 65%. Sources said dilution would depend upon the valuation.

“In case of good valuation, the company may exit completely. Or, it can retain 26% stake but give ma-nagement control to the successful suitor in the first phase. It may also enter into a binding agreement with the successful bidder to sell the residual stake in future,” said the person.

In 2017, some of the institutional investors in PTC proposed to appoint their representative on its board, citing undervalued stock and financial inefficiency.

“The background of the proposed transactions comes from an increasing focus on efficient capital allocation.

The subsidiaries have business in financial services and energy assets. The synergies and fit of these business with PTC’s core operations have diminished over the past 5-6 years. At the same time, the electricity market is growing and throwing up new opportunities,” said the first person, who is close to one of the shareholders.

PTC Energy has an equity base of Rs 654.11 crore. It recorded revenue from operations of Rs 331.47 crore in fiscal 2018-19 and a profit before tax of Rs 74 crore. It operates wind energy projects — 50 MW each in Madhya Pradesh and Karnataka, and 188.8 MW in Andhra Pradesh.

PTC India Financial Services is classified as an infrastructure finance company by the Reserve Bank of India. PTC has invested Rs 754.77 crore in the company, which recorded a profit before tax of Rs 281crore on revenue of Rs 1,336.51 crore in fiscal 2019.