Ratings for renewable energy: Metrics and evaluation for renewable energy/infrastructure project risk

This paper proposes a framework that allows transparent evaluation of renewable energy infrastructure projects. While there has been substantial increase in renewable energy investment in the last decade, a gap still exists between the actual capital flows and what is required to meet climate-mitigation targets. This report builds on a review of the current renewable-energy infrastructure investment and summarises the discussions that took place during a workshop on renewable investment held in London.

Attribution: Aled Jones, “Ratings for Renewable Energy: Metrics and Evaluation for Renewable Energy/Infrastructure Project Risk”, ORF Special Report No. 87, April 2019, Observer Research Foundation.

Background

Over the next few decades, there will be a huge requirement for capital investment into energy infrastructure, in both supply and consumption. Approximately US$270 trillion is due to be invested into the energy system between 2007 and 2050 (IEA, 2009). Additionally, the scale of opportunity to invest in solutions that address global sustainability challenges, such as climate change, is often seen as a new technology revolution (Linnenluecke et al., 2016). While estimates vary, they broadly coalesce around the need for an additional US$1 trillion per annum in investment required in energy infrastructure over the next 30 years. It is crucial to target policy and business interventions to enable capital to flow into these investments and, consequently, to understand and measure the risk associated with them.

Over the past few decades, resource and energy efficiency have dominated environmental finance. Corporate investment into best practices has often been for cost-saving purposes, not based on external or specifically environmental drivers. However, additional incentives, such as the creation of a trading scheme to put a price on carbon (Convery & Redmond, 2007), have driven more investment into efficiency than would otherwise have occurred.

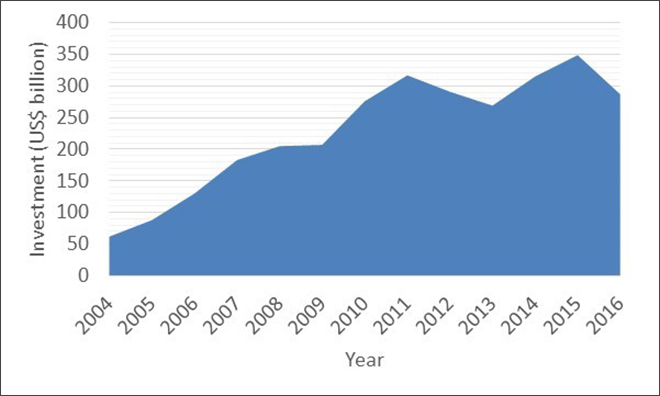

Globally, clean-energy investment crossed US$200 billion in 2010 (Frankfurt School-UNEP Centre, 2013; PEW Charitable Trust, 2010; WEF, 2011), with investments in infrastructure accounting for over half. China saw the highest proportion of this investment at US$54 billion. Investments amounted to US$350 billion in 2015 but declined by 18 percent in 2016 (See Figure 1). Asia receives the bulk of investments, just under half of the total investment in 2016. Renewable energy capacity investments in 2016 reached US$227 billion, with the vast majority being in wind and solar technologies (See Figure 1). These investments represent a substantial market.

Figure 1: Investment in Clean Energy (2004-2016)

Despite this large investment market, there is a distinct gap between what is required and what is being delivered. In particular, developing countries’ requirement for investment is estimated to be US$240–640 billion per annum by 2030, of which only 40 percent is currently being invested by both public and private sources (Vivid Economics, 2014). Private finance is relatively smaller in developing countries than in developed countries. Estimates put private investment at 88 percent of the total in developed countries and 57 percent in developing countries (Vivid Economics, 2014).

Most imagined scenarios for combating climate change include a significant role for carbon capture and storage or biofuel (to enable biomass carbon capture and storage), which, too, are inadequately funded. Additionally, while there has been a global rise in clean-energy investment, much of it has been concentrated geographically, particularly in China. A significant part of the increase in investment is due to public-sector organisations, such as state utilities (Mazzucato & Semieniuk, 2018), increasing their direct investment instead of creating of a supportive policy regime to attract more private-sector finance.

When examining climate-change related investments globally, institutional investors are found to be a negligible source of total investment, the majority (over US$120 billion per annum) of investment being from project developers and corporates (just under US$80 billion per annum). However, as part of the United Nations Climate Summit, led by the UN Secretary General, several private-investment funds made commitments to increase their investments in low-carbon sectors by 2020. Substantial progress was made in the first year (See Table 1).

Table 1: Private-Sector Commitments made during the UN Climate Summit in 2014 and their Delivery during the First Year (UN, 2015)

| Organisation | Original commitment/target | Progress over the last year | Assessment |

| International Cooperative and Mutual Insurance Federation (ICMIF)/ International Insurance Industry | Doubling of ‘climate-smart’ investments to reach US$84 billion by COP21, and a tenfold increase by 2020 | US$109 billion by July 2015, expected to reach US$130 billion by October, 2015 | Reached initial target |

| Portfolio Decarbonisation Coalition | To mobilise investors to commit to collectively carbon footprint US$500 billion of Assets under Management and to decarbonise US$100 billion of these assets | Decarbonisation commitment of US$63 billion reached, expected to increase to US$75 billion by October, 2015; Investors have committed via the UNPRI-organised Montréal Pledge to carbon footprint US$3 trillion of investments | On track |

| CalSTRS, APG, Pension Danmark | To allocate more than US$31 billion to ‘low-carbon’ investments by 2020 | Currently around US$29 billion allocated, an increase of US$11 billion over the year | On track |

| Swiss Re | Advise 50 sovereigns and sub-sovereigns on climate risk resilience and to offer them protection of US$10 billion against this risk | Advised nine sovereigns and sub-sovereigns (seven from developing countries) and offered protection of more than US$1.5 billion (of which US$1.1 billion offered to developing countries) | On track |

| Bank of America | Catalytic Finance Initiative (CFI): US$10 billion of new investment in high-impact clean energy products by 2022 | Closed around 10 deals totalling US$1.5 billion (of which US$250m from its balance sheet); US$400m of deals in emerging markets. | On track |

Some analysts argue that trustees of institutional funds can only take social or environmental considerations into account (Sandberg, 2011) in very specific cases. However, counter arguments suggest that they are already legally required to do so (Sethi, 2005).

Increasingly, the renewable-energy sector is seen as a maturing asset for investment. The risk perceptions associated with certain technology deployment has been changing over time. The price of technology-generated electricity is also changing, with many now being grid comparable, leading to an increased appetite for investment. Mazzucato and Semieniuk (2018) classified the risk associated with a number of renewable technologies as either low, medium or high (See Table 2).

Table 2: Technology Risk Classification for Various Renewable Energy Technologies in 2014

| Technology | Risk | |

| Wind | Onshore | Low |

| Offshore | High | |

| Solar | Crystalline-silicon PV | High (2004–06), medium (2007–09), low (2010–14) |

| Thin-film PV | High (2004–09), medium (2010–14) | |

| Concentrator PV | High | |

| Concentrated Solar Power | High | |

| Biofuels | First generation | Low |

| Second generation | High | |

| Biomass and waste | Incineration | Low |

| Other biomass | Medium | |

| Geothermal | Medium | |

| Marine | High | |

| Small hydro | Low | |

Source: Mazzucato & Semieniuk, 2018.

The private sector will continue to invest significant capital into energy projects over the next few decades. Thus, policymakers must figure out how to influence strategic choices towards renewable energy investments and away from conventional energy investment (Wustenhagen & Menichetti, 2012).

To scale up investment into renewable infrastructure, it is crucial to have a long-term stable policy (IIGCC, 2011, UNEP & Partners, 2009). According to investors, this is currently lacking (Jones, 2015). Low-carbon investments offer both opportunities and risks, which require a different approach to policy development (Foxon, 2011; Hilden, 2011; Safarzynska et al., 2012). Policy design is critical (Wustenhagen & Menichetti, 2009) in encouraging investment in renewables. The lack of sufficient policy design leads to badly designed markets, which, in turn, results in retrospective policy changes, undermining trust in the investment climate (Jones, 2015).

Investment Metrics

The Private Infrastructure Development Group (PIDG, 2012) have developed a methodology for assessing the mitigation potential of infrastructure projects, using a three-tier system for classification:

- Tier 1: Projects whose principal objective is to mitigate climate change and/or whose actions can be considered a step-change in terms of reducing GHG emissions

- Tier 2: Projects where climate-change mitigation forms an important part of the project scope and/or where GHG emission reductions are incremental

- Tier 3: Projects that do not have climate-change mitigation co-benefits or are only likely to lead to indirect mitigation co-benefits

These classifications are currently qualitative. Assessing carbon savings, crucial for renewable-energy investments, as part of a quantified approach to developing a metric is difficult, since any emissions reduction is measured in relation to a ‘business as usual’ (BaU) scenario. The BaU scenario is subjective, specifically in developing countries, where it is unclear what technologies are being substituted and how the economic growth and development aspirations of countries should be factored into defining these scenarios. Recommendations for how to use and create scenario analysis are currently under development (TCFD, 2017).

Increasingly, many projects, especially those blended with private-sector capital, require reporting (in some form or another) of quantified emission reductions (see for example, Bank of England, 2015 and ShareAction, 2015). Therefore, for renewable projects, a quantitative measure of emission reduction over BaU potential is critical. The assumptions underpinning the BaU scenario/s and their quantification must be disclosed. However, this quantification may be difficult, particularly in cases where assumptions have to be made about alternative future investments and energy options or where the emissions from existing (very disperse) energy usage have not been measured. Nonetheless, detailed guidelines have already been developed (Green Climate Fund, 2014a), and the multilateral development banks are using a toolkit developed by the International Finance Corporation to assess their emissions savings (IFC, 2013). An excel worksheet is available online (IFC, 2014).

There are many ways to quantify emissions savings, such as the indicator developed and proposed under the Green Climate Fund (2014b, 2014a), which includes tonnes of carbon dioxide equivalent (tCO2-eq) per dollar invested as a measure of efficiency of investments made (Green Climate Fund, 2014b).

For power-generation projects, four main rating factors are considered (Moody’s, 2017a):

- Predictability of Cash Flows

- Competitiveness/Regulatory Support

- Technical and Operating Risks/Vendor Profile

- Key Financial Metrics

As noted above, the importance of regulatory support and long-term commitments from governments to see an energy transformation is vital to ensure a risk measure that is favourable towards renewable-energy investments.

An additional consideration is the ‘paradigm shift potential’ (Green Climate Fund, 2014b), i.e. if the project provides demonstration potential for a new technology or deployment of a technology in a new geography. For example, in their Green Bond rating proposal, Standard & Poors (S&P, 2016) uses a net-benefit approach to measure the impact of a project. Part of this approach includes measuring the potential for the technology to provide a systemic change towards a green economy, as well as investments that extend the life of fossil fuel use.

The concept of stranded assets (Carbon Tracker, 2013) is gaining significant traction across the investment community, including multilateral development banks (Caldecott, 2015). For example, the valuation of any power station whose primary source of fuel is coal, oil or gas could be materially impacted by future regulation. Such regulation can include international climate agreements, national environmental regulation or international trade agreements. International trade regulations, under the World Trade Organisation, are increasingly subject to discussions focusing on improving the coherence of climate and trade policies (WTO, 2016) and may, in future, include the concept of embodied emissions.

A recent announcement at the UN Conference of the Parties in Mexico by the Climate Vulnerable Forum represents 48 of the most vulnerable countries in the world and aims to make these countries 100 percent renewable by 2050 (Payton, 2016). As these countries implement policies to achieve this goal, the concept of stranded assets may become more material than they currently are in some developed countries. Therefore, projects that have greenhouse gas emissions, which have not been actively considered but may materially impact the valuation of the asset under future (carbon) regulation, should have a considerable risk weighting attached to them.

Discussion

On 4 December 2017, a workshop was held at the Institute and Faculty of Actuaries in London, UK. The workshop brought together 16 experts in risk and investment. The overarching aim was to explore how risk can potentially drive private capital, in all its forms, to climate action projects. The workshop started with a discussion of the constraints and barriers to asset owners and their investment managers, making significant inroads into infrastructure investments in emerging market economies. However, the bulk of the discussions focused on risks and risk metrics, how they are used in investment decisions and how they are both a barrier and an opportunity for scaling up such investments. This section builds on those discussions.

When developing metrics or measures to increase investments towards renewable energy projects, it is important to distinguish between ‘investment managers’ (asset gatherers) who require increased human capacity to scale up investments and ‘asset owners’ who need to see an increase in demand for their capital towards these projects. Asset owners must also make it clear that they want to make these investments, although many argue that they have been calling for long-term policy changes to enable this shift for over a decade. Predictability of the regulatory framework is key for risk management. However, there is now evidence of good and best practices in renewable-infrastructure investment, as well as divestment away from fossil fuels, the most recent of which is the Norwegian pension fund that has created a green-investment window. The move to renewables is also more likely with the price of electricity from renewables approaching grid parity, as it has in a number of countries. Grid parity price changes the main risk from counter party/sovereign risk to market risk as projects become less reliant on government subsidies for the returns.

Several examples of public–private partnerships now exist. Institutional investors have taken early issues of green bonds from organisations such as the World Bank and International Finance Corporation. New private equity and infrastructure public-private partnerships have been set up, which utilise the knowledge of public organisations in investing in developing and emerging markets to reduce risk and create diversified risk by enabling investments across countries. However, if these investments are in partnership with national development banks, they do not alleviate any country risk.

To increase the supply of capital, institutional investor governance should better incorporate the full range of risk analysis and understanding as outlined here. Different governments are taking different approaches to encourage this, e.g. the French top-down regulation on governance and the UK’s Bank of England bottom-up approach to risk-management advice. However, regulation can often be a deterrent to more proactive measures from investors and the UK’s Prudential Regulation Authority (PRA) approach to capital adequacy requires investors to prove a detailed understanding of risks and how to model them, which can often take six months to approve new risk models. Indeed, even if the existing models are incorrect (they do not take into account climate change), including new models is difficult. Therefore, a more pragmatic and partnership approach is necessary to speed up the transition to renewables.

In developing countries, while there is an increasing pool of investment opportunities, there is still not enough supply of projects at the required aggregated scale. Therefore, there is little incentive to invest in human capital within asset management firms (an exception being boutique firms). Increasing this pool of opportunities to create risk diversification should also go hand-in-hand with learning lessons from these projects so as to better structure investment opportunities. For example, future partnerships should involve the full life cycle of the projects, with institutional investors as part of the refinancing and project developers providing the construction finance. Structuring investments over a 30-year project is not straightforward, and new approaches and techniques are needed to measure and handle risk over this duration.

This is not just a problem for developing countries. There is a lack of eligible assets in Europe as well. While technology risk has reduced, and the cost of technologies has dramatically fallen, these have not been fully incorporated into investment metrics as yet. The risk associated with these technologies is not being priced accurately. Moreover, the risk in investments is changing rapidly with key markets such as the UK and the US seeing dramatic changes in their risk profiles, given Brexit and the election of President Trump.

In the short term, it is necessary to make existing projects investment-grade or to create the conditions in which investors are comfortable investing is sub-grade projects. In addition to technology risks, there is a range of country-specific risks that can often be more important in risk metrics. These include:

- Currency risk (hedge cost is high)

- Political risk

- Credit strength of counter parties

- Legal frameworks

- Transparency

To hedge country-risk, long-dated debt denominated in the national currency is crucial. Thus, countries without long-dated debt are at a disadvantage, even more so in the case of developing countries. Approximately half of the defaults in emerging market investments are related to country risk, whereas half the defaults in developed markets are due to project risk.

Over the last 10 years, emerging market investments have become a necessity for asset owners to ensure diversified risk exposure. In addition, it has become necessary to move away from hyper-liquid equity markets and invest more in infrastructure. Infrastructure investment naturally aligns with the long-term liabilities of institutional investors, although the way they are regulated can sometimes make this difficult to show in practice. The ongoing political process within the UN Framework Convention on Climate Change Conference of the Parties makes renewable energy transition more attractive, and the fossil fuel industry is now seen as a sunset industry. Even with new technologies and techniques being developed in fossil fuels, the recent experience of investing in areas such as fracking has shown that these have significant risk associated with them. Therefore, the direction of travel for investors is clear, although it takes a long time for this to be institutionalised within investment organisations.

The use of metrics to assess risk on renewable infrastructure projects is an emerging competence within the finance sector. While both S&P and Moody’s have transparent approaches to risk ratings of power-generation projects, and both have measures to assess climate-change resilience, the history of using these metrics is limited, with the majority of ratings having been done since 2016. Green bonds associated with renewable infrastructure is a rapidly growing market and—with the issuance of local standards in countries such as India in 2016 and the adoption of common principles in 2017—more evidence on the actual risk in this sector will emerge over the next few years (Moody’s, 2017b). However, the volume of green bonds rated is still quite low, with Moody’s only having rated 25 transactions by the end of 2017 (Moody’s, 2017b).

Fossil-fuel investments and metrics have decades of data within each organisation. Thus, learning from the use, including their accuracy, can be built upon. The key difference between renewable-infrastructure metrics and existing power-project metrics is the need for transparency through reporting on emissions saved. To scale up renewables, it is critical to share data and information across organisations to help achieve the same scale of knowledge and learning. The perception of the usefulness of the current index measures (such as those used by Bloomberg New Energy Finance and Ernst & Young) are mixed, and the methodology behind the index are not transparent. Therefore, there may be a role to create a new public body, or charitable body, that can create and manage a transparent index or metric to measure these risks, collate data from projects and build capacity within the finance sector. The World Bank has launched a pilot, although this only focuses on developing countries, the need to aggregate data between developing and developed countries being key.

Conclusion

There still exists a fundamental policy uncertainty regarding energy transition. Governments have been hesitant to ‘pick winners’ within the renewables sector, although they do this in other sectors all the time. The issue of carbon entanglement, where some governments receive substantial revenues from the fossil-fuel sector, must also be factored into future scenarios and risk measures.

There is a need for greater transparency and coordination to achieve the necessary scale in as short a time as possible. Compared to 10 years ago, there are currently several examples of good and best practices. Thus, there is a platform from which to build future partnerships for investment. The next 10 years will likely look very different.

Recommendation for a Metric Framework

Creating a detailed metric that will allow transparent evaluation of renewable-energy infrastructure projects requires a process that engages relevant investors to ensure its wide adoption. The following is suggested as an initial proposal to be used as a basis to kickstart such discussions. These metrics should be implemented alongside standard infrastructure risk metrics.

- Carbon Emissions Saving over Business as Usual

- Use IFC Carbon Emissions Estimation Tool (IFC, 2014) as the basis

- Regulatory Exposure Score

- 1=dependent on subsidy support; 0=grid comparable

- This score to be used to weight a Country-Risk Score (such that a technology that is not dependent on regulatory support has lower risk associated with it than one that is dependent on regulatory support)

- Paradigm Shift Potential

- Scale of 0 to 10, on whether the particular project/asset demonstrates a contribution to radical change in future energy transition scenarios

- Stranded asset potential

- 1=potential to be stranded, 0=not stranded

- This score to weight the overall investment-risk calculation depending on timescales involved.

This Special Report was first published as Chapter 4 in Financing Green Transitions, a monograph published by ORF in January 2019.

About the Author

Dr. Aled Jones is the inaugural Director of the Global Sustainability Institute (GSI) at Anglia Ruskin University.