The Texas power market is designed to play chicken with blackouts. Is the model sustainable in a high-renewables system?

Last week as Texas’ ERCOT grid reached its price cap of $9,000 per megawatt-hour and the price map on ERCOT’s website became a solid and deep red, many energy market wonks highlighted that this is a feature, not a failure, of the market.

Texas’ summer heat — one of the few things the industry can rely on — brings scarcity prices that encourage the construction of new projects to restore some cushion to low reserve margins and a return to low power prices. ERCOT’s defenders cite it as a more open and efficient, if unnerving, system.

The Texas power market is designed to play chicken with blackouts, but the real question moving forward is if the model is sustainable in a high-renewables power system.

The question of designing power markets for a carbon-free grid is by no means limited to ERCOT. It will be wrestled with the world over as policymakers add a “carbon-free” clause to the traditional mandate that markets provide reliable and low-cost power. While wind and solar have been growing, no large power system in the world was over 30 percent wind and solar generation in 2018. Renewables growth to this point has not been without issue or contention, but market operators and asset owners are only beginning to experience the ramifications of cost-effective renewable energy and high penetration renewable energy systems.

The Wood Mackenzie team recently explored the potential costs of rapid power system decarbonization in the U.S. and the operational and technological challenges of taking a nearly carbon-free grid to 100 percent in Uruguay. The underlying challenge will be for policymakers, regulators and operators to design a solution to most efficiently solve these challenges.

Texas provides a unique lens to observe how significant this clause will be on power market design. Power prices remain the primary signal for new investments even in markets with capacity mechanisms, but in Texas they are the only signal. Wood Mackenzie expects wind to represent over 20 percent of ERCOT’s generation in 2019; however, it is the anticipated solar growth from just over 1 percent to 6.5 percent by 2030 that threatens to undercut the market.

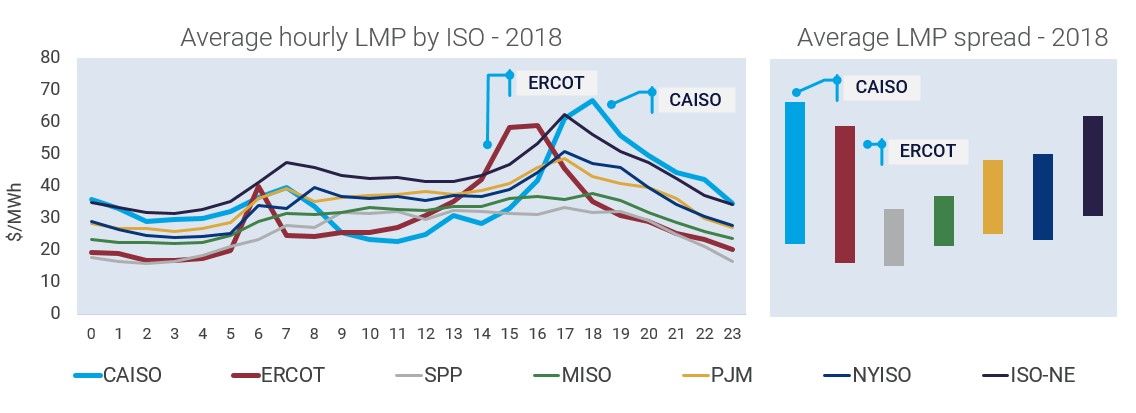

Texas’ peak price is immensely fragile, even today. Removing the top 10 highest-priced hours from the year reduces Texas’ typical daily power price spread by over 40 percent. ERCOT’s year-round average power prices are expected to rise over 10 percent by 2030, but only to a still-low $33 per megawatt-hour. By contrast, August on-peak power prices are expected to fall by a nearly identical amount by 2030.

Solar’s early growth is going to directly eat into every other plant’s profit, and eventually its own. Just like the (in)famous California duck curve, price peaks will shift to when the sun sets, but whereas California has instituted myriad policy mandates, regulatory mechanisms and reliability contracts to advance investments in new carbon-free solutions and keep the lights on, Texas will likely be “policy-light” by comparison.

It remains to be seen if Texas power investors will keep up with the pace of change or if regulators will flinch in the face of uncertainty.

Source: Wood Mackenzie North America Power & Renewables Service

The ultimate design and timing of specific policy and regulatory solutions that are advanced to address these issues will vary significantly by market. Broadly, there are two trends that will shape power markets: the creation of value-based price signals and an expansion of the solutions competing to capture them.

Value of power will eclipse cost of energy as investment driver

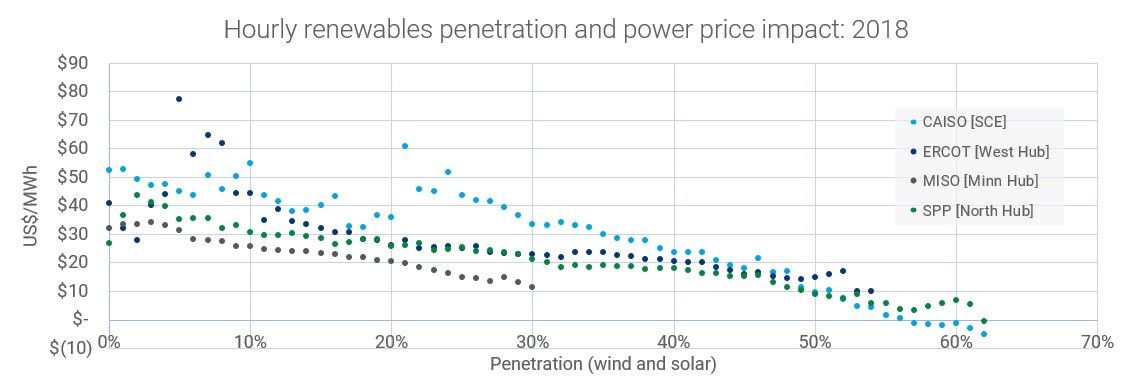

Wind, solar and storage continue to see their costs of power decline, with a new record-low solar contract in Portugal last month as just the latest example. But such cost declines will become increasingly irrelevant as penetration levels pick up in markets around the world.

Even with continued declines in their costs of energy, wind and solar will struggle to sustain investment when exposed to sub-$20 per megawatt-hour prices. The rapid rise of pairing battery storage with wind and solar is directly attributable to the need to shift low-cost generation to the most valuable times. Current lithium-ion battery storage technology and a natural balancing of local wind and solar resources will help optimize intra-day operations and raise the threshold levels of economic and reliable wind and solar integration.

However, these solutions will not be enough to achieve a carbon-free grid.

Source: Wood Mackenzie North America Power & Renewables Service

Looking at the current relationship between power prices and the penetration of wind and solar on the grid at the hourly level highlights how these current sporadic moments of high penetration will create systemic issues when scaled to annual levels. Intra-day optimizations will ultimately flatten the primary energy price signals that have largely incentivized new capacity investments. At majority wind and solar penetrations (i.e., more than 50 percent to 60 percent), the market need will shift from daily dispatch to monthly and seasonal availability. Energy price signals are likely to be insufficient to bring new capacity or alternative solutions to market.

A combination of potentially extreme volatility and unbankable uncertainty will compel many market operators and regulators to redesign power markets to meet the low-cost, reliable and carbon-free mandate. This leads to a second trend that will be increasingly common and critical feature in feature power market design.

Demand will increasingly be viewed as an equal to supply

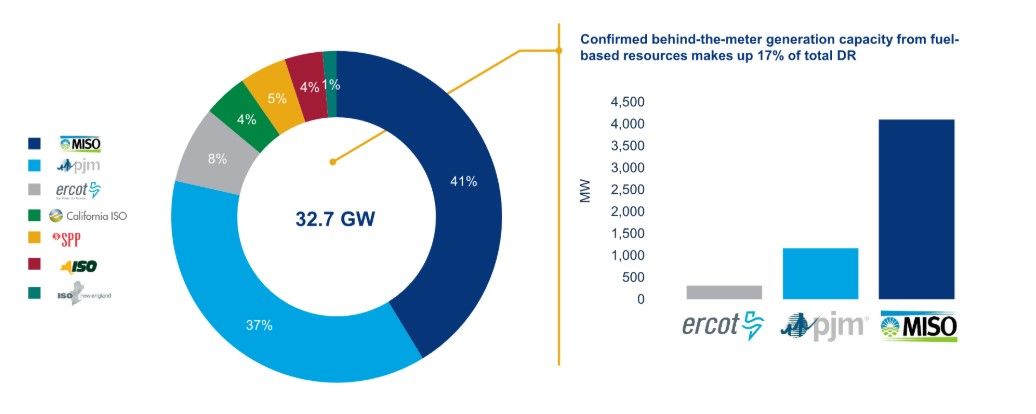

Many markets, including ERCOT, already have demand-side management programs. Wood Mackenzie tracks over 32 gigawatts of demand-side capacity already participating in organized U.S. power markets, as well as gigawatts more in unorganized regions. While demand participation will not solve all the seasonal challenges in a high-renewables grid, it is a critical aspect of addressing the more momentary balancing and optimization needs.

Source: Wood Mackenzie U.S. Wholesale DER Aggregation, Q1 and Q2 2019

The grid edge represents the entire ecosystem of decentralized and distributed generation, and the rapid advance of technologies is reducing the costs and sources of friction serving as barriers to customer participation in power markets. The orchestration of these devices is transforming demand from an exogenous input into power system planning to an active market participant that generators must compete against in addressing system needs.

In the warming world, extreme events will become both more regular and more intense and serve as a valuable benchmark in determining if power markets are able to deliver their expanded mandate of reliable, low-cost and carbon-free power.

****

Matt DaPrato is the product suite director at Wood Mackenzie Power & Renewables.