WoodMac: A New Battery Chemistry Will Lead the Stationary Energy Storage Market by 2030

Lithium-iron-phosphate batteries will rapidly rise in popularity as the market begins differentiating between EVs and stationary storage.

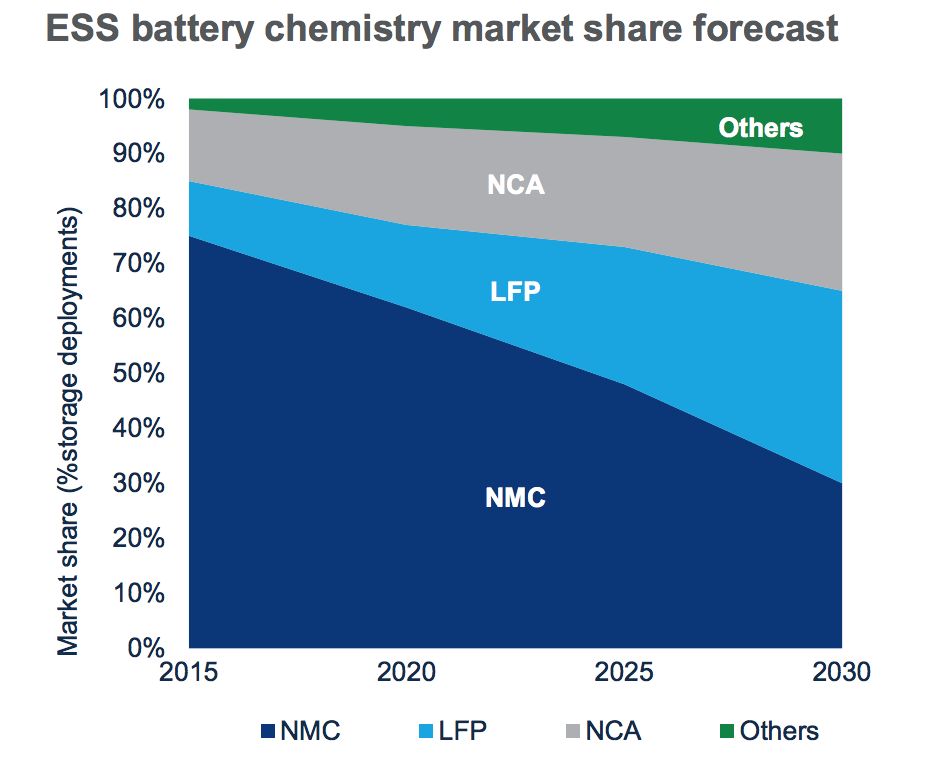

Lithium-iron-phosphate (LFP) will become increasingly popular for stationary energy storage applications, overtaking lithium-manganese-cobalt-oxide (NMC) within a decade, Wood Mackenzie forecast in a new report.

As demand from electric vehicles and the stationary storage market both skyrocket in this decade, evolving performance priorities will create a divergence between the types of batteries used for storage and those used for EV applications.

It started with a supply crunch

Historically, the energy storage market has mostly deployed NMC batteries. In late 2018 and early 2019, demand for NMC batteries to be used for energy storage applications grew swiftly, outstripping the available supply.

The rapid rise in demand for EVs since 2010 had driven down the cost of lithium-ion batteries by more than 85 percent. As lead times for NMC availability grew and prices remained flat, LFP vendors began tapping into NMC-constrained markets at competitive prices, thus making LFP an attractive option for both power and energy applications.

Now, it looks like LFP has attained sufficient momentum to overtake NMC as the leading stationary storage chemistry by 2030.

LFP will grow its market share from 10 percent of the stationary storage market in 2015 to more than 30 percent by the end of the decade.

Two markets, two sets of priorities

Even as the stationary energy storage market takes off, EVs will continue to account for the lion’s share of global lithium-ion battery demand over the next 10 years.

Rising storage and EV demand will in turn drive manufacturers to innovate and specialize their product offerings for each market.

Manufacturers will focus on high cycling capabilities and high frequency for the stationary storage market, likely prioritizing these factors over energy density and reliability for the stationary storage market.

Cost and safety will continue to be top of mind for battery vendors across multiple applications. Beyond the technology’s cost and safety advantages, a shift toward LFP means manufacturers won’t have to worry about issues surrounding the supply of cobalt and nickel.

LFP is becoming a more attractive proposition in the passenger EV space, largely due to improvements in gravimetric energy density combined with cell-to-pack technology.

***